Wisconsin Car Insurance

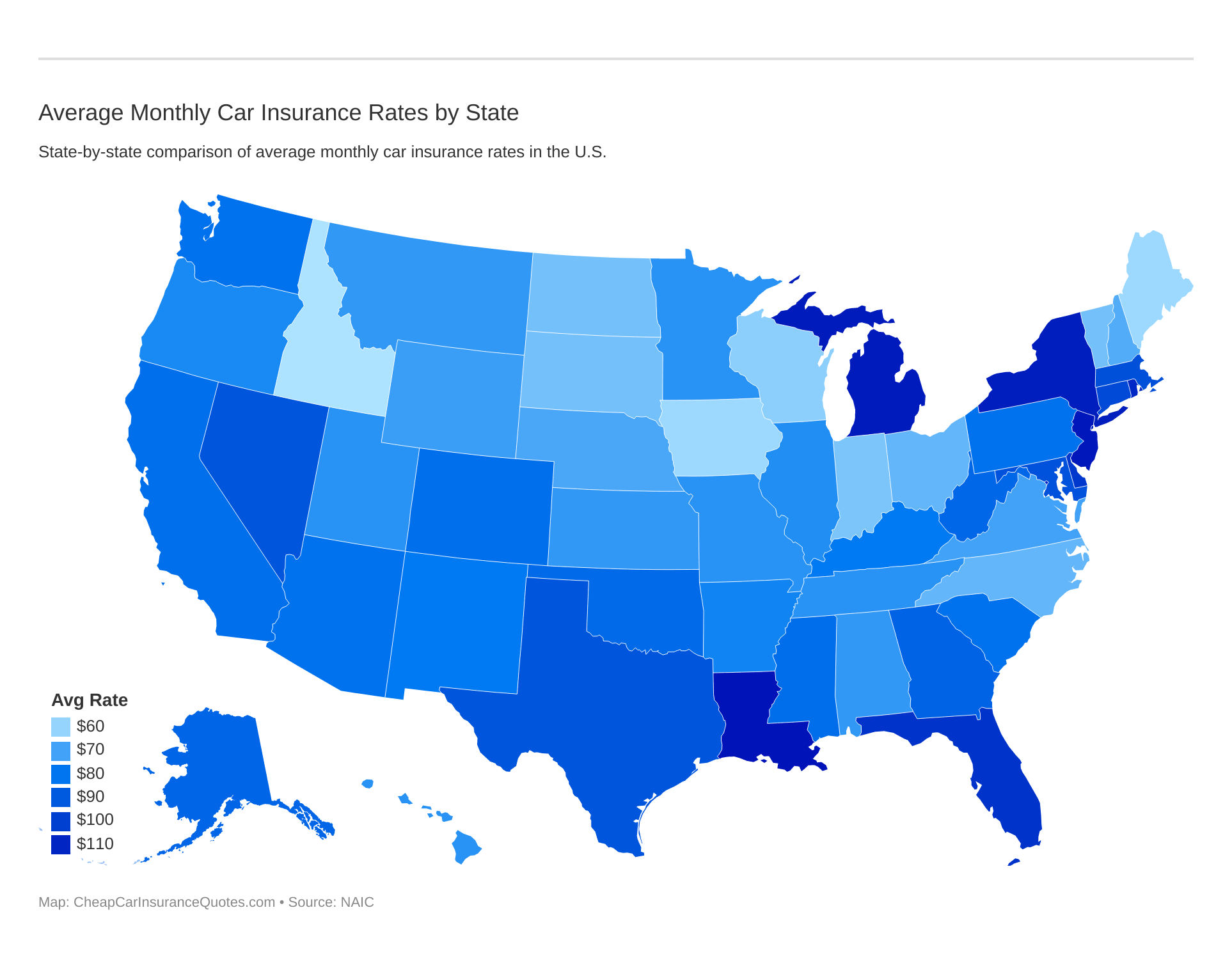

Wisconsin car insurance costs $86/mo, or $1,040/yr on average. This is 27.1 percent below the national average. Mandatory Wisconsin auto insurance laws only came into effect on June 1st of 2010 and minimum car insurance requirements are 50/25/10. You must meet Wisconsin car insurance requirements to legally drive in the state. Find cheap coverage here with our free quote comparison tool below.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larsen

Licensed Auto Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Auto Insurance Agent

UPDATED: Feb 16, 2024

It’s all about you. We want to help you make the right cheap car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare cheap car insurance quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Feb 16, 2024

It’s all about you. We want to help you make the right cheap car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare cheap car insurance quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Starting June 1st, all vehicles registered in Wisconsin must carry liability car insurance

- Finding affordable car insurance is pretty easy but you still need to make sure you have the right type of coverage before its time to file a claim

- All typical private passenger vehicles require proof of insurance before registration

Wisconsin drivers enjoy almost the lowest average car insurance premiums in the nation and just recently were required to carry car insurance.

Mandatory car insurance laws only came in effect on June 1st of 2010 for vehicles registered in Wisconsin and minimum car insurance requirements are much greater than almost every other state.

Enter your zip code above to get FREE car insurance quotes today!

Wisconsin Car Insurance Laws

https://www.youtube.com/watch?v=LH-6wizPE-g

While there are some exceptions, all typical private passenger vehicles require proof of insurance before registration.

There are also heavy penalties for driving with no insurance so you must maintain car insurance in-force at all times.

The new Wisconsin liability car insurance requirements are:

— Liability Insurance

- $50,000 liability insurance per person per accident

- $100,000 liability insurance per accident (all persons)

- $15,000 property damage liability

— Underinsured and Underinsured Motorist Coverage

- $100,000 liability insurance per person per accident

- $300,000 liability insurance per accident (all persons)

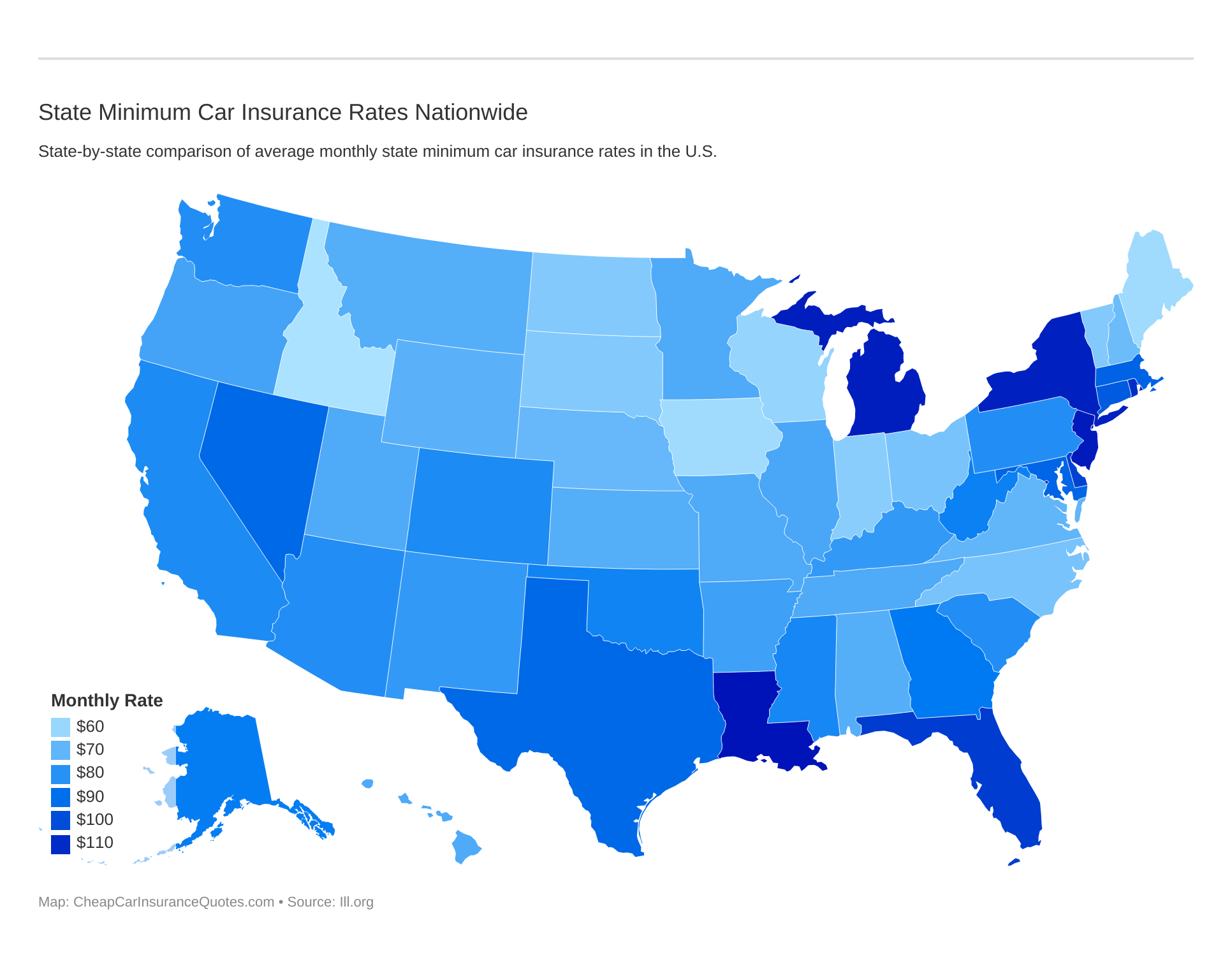

State minimum auto insurance rates and requirements vary from state to state. Compare state to state below:

- Wisconsin

- Cheap Quotes for Vesper, WI Car Insurance (2026)

- Cheap Quotes for Shullsburg, WI Car Insurance (2026)

- Cheap Quotes for Sauk City, WI Car Insurance (2026)

- Cheap Quotes for Mikana, WI Car Insurance (2026)

- Cheap Quotes for Hillsboro, WI Car Insurance (2026)

- Cheap Quotes for Germantown, WI Car Insurance (2026)

- Cheap Quotes for Columbus, WI Car Insurance (2026)

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

While these car insurance requirements are surely some of the highest minimum mandatory requirements in America, it’s important to know that Wisconsin car insurance laws only require liability insurance for injuries/damages sustained to others.

Any damages to your vehicle from an accident you were at-fault will not be covered, so you should consider also purchasing comprehensive and collision coverage.

Many other types of auto insurance are available including GAP and rental car reimbursements, so regardless if you have ever had car insurance in the past, now is a good time to speak with a Wisconsin car insurance company.

Your average monthly car insurance rates may not increase as much as you might think by adding additional coverage like comprehensive. Review rates for auto insurance coverage below:

Wisconsin Car Insurance Companies

As you can imagine with such new state laws requiring Wisconsin drivers to obtain car insurance, a wealth of auto insurers are competing for your business.

Finding affordable car insurance is pretty easy but you still need to make sure you have the right type of coverage before its time to file a claim.

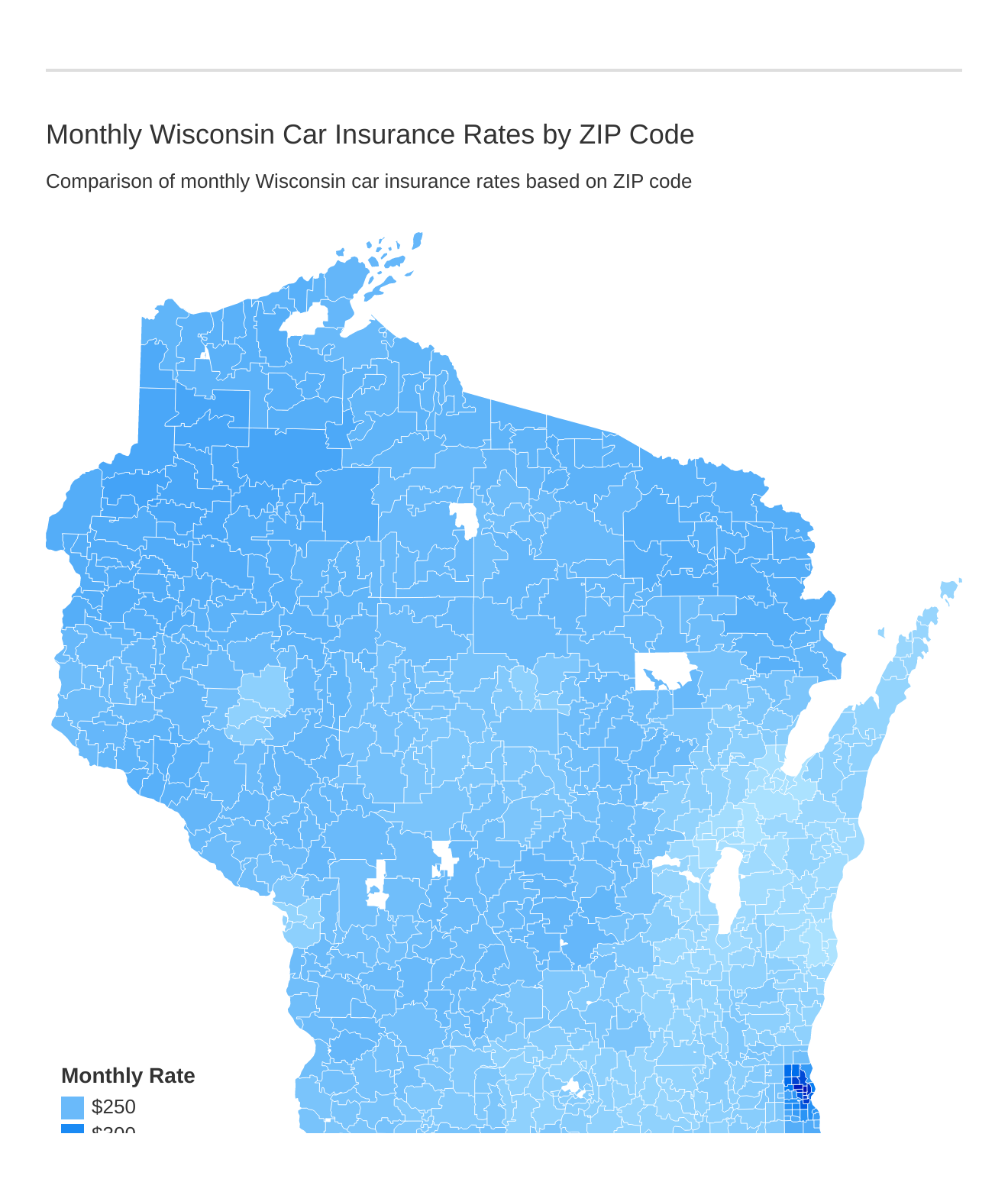

ZIP codes affect auto insurance because of factors like traffic, crime to name a few. Find out how your ZIP code stacks up in Wisconsin.

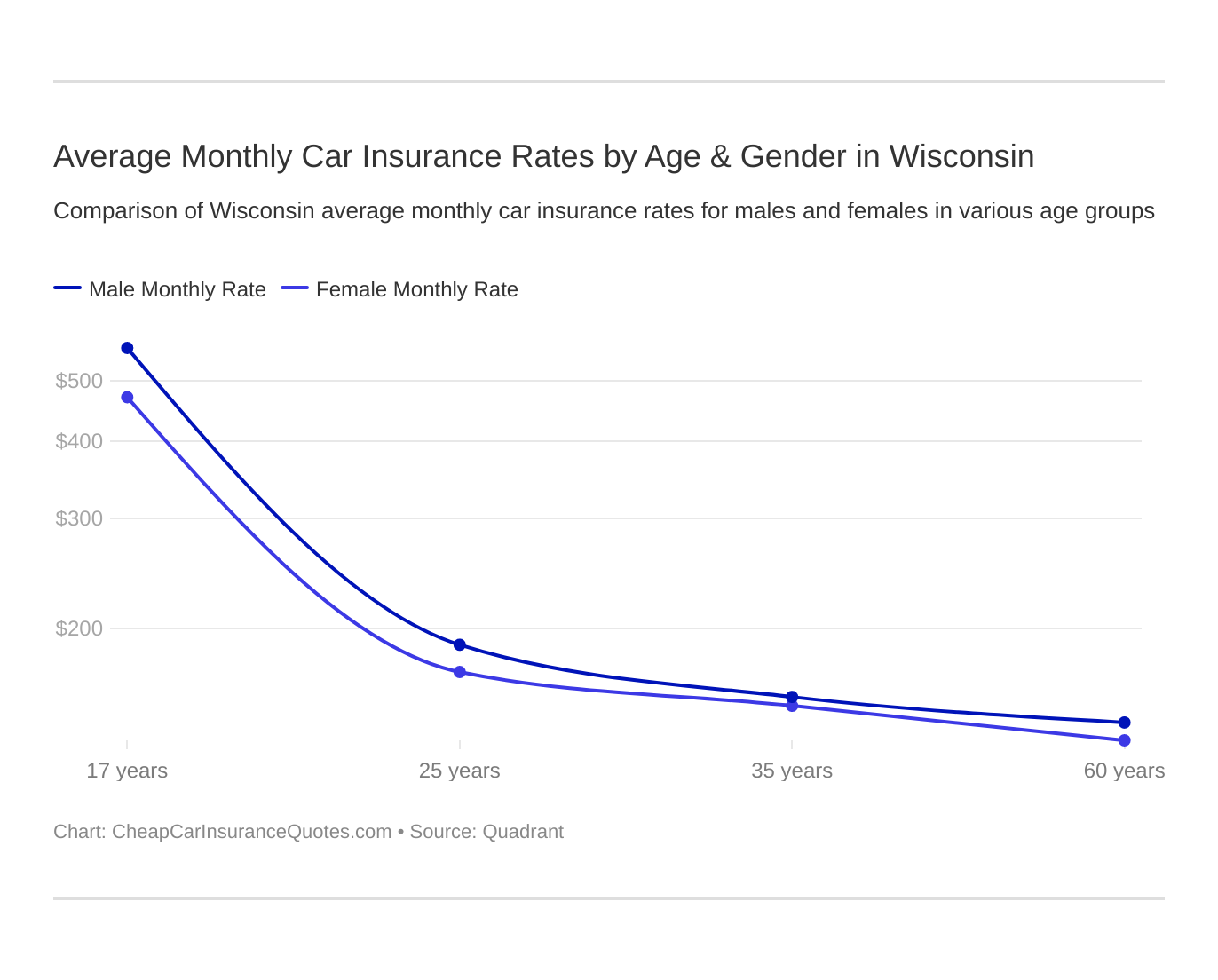

Gender and age will affect your auto insurance. Younger drivers are often in a higher risk class. See if the gender stereotype (males vs female car insurance rates) holds true in WI.

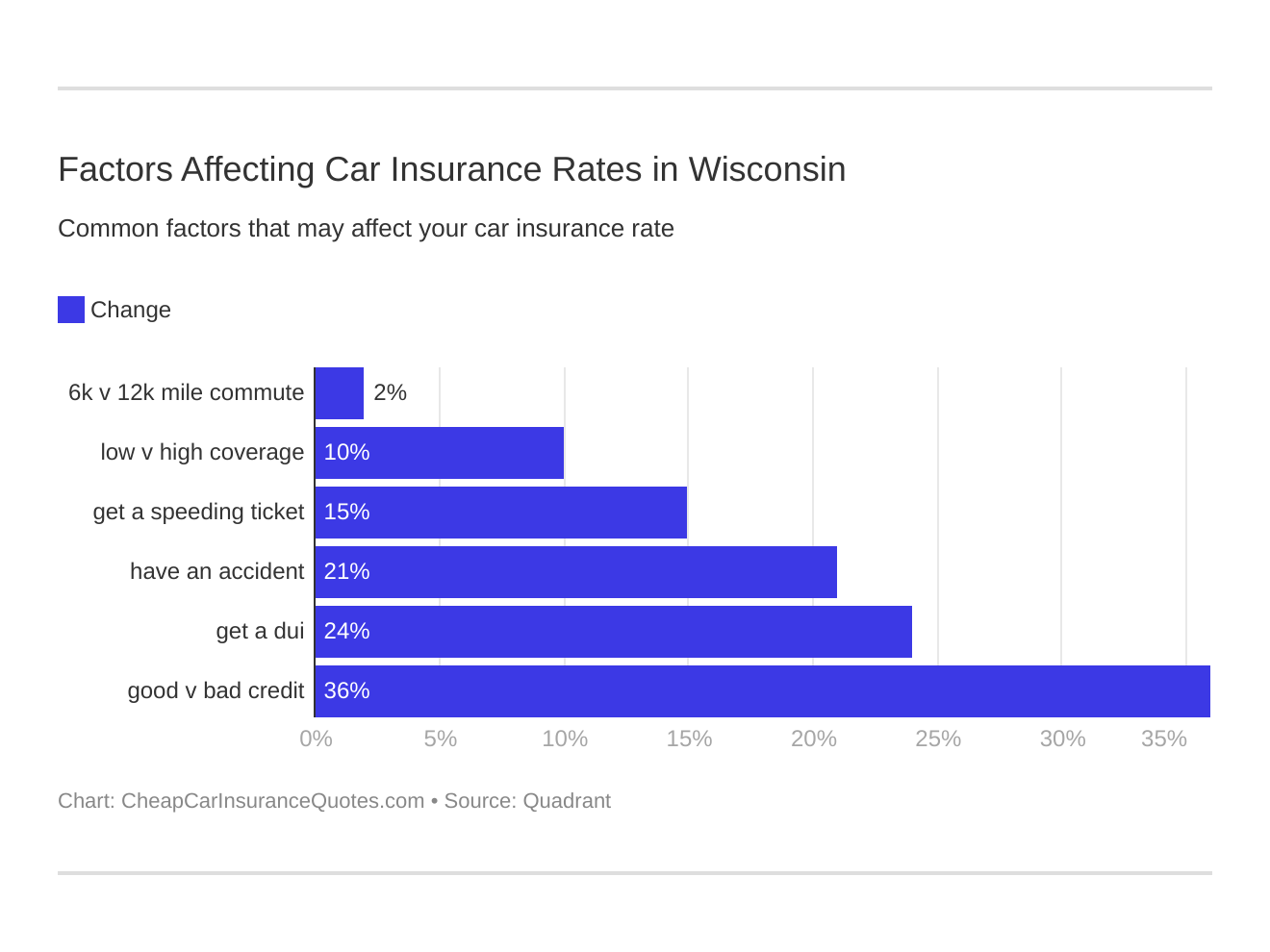

Six major factors affect car insurance rates in Wisconsin. Which auto insurance factors will affect rates the most? Find out below:

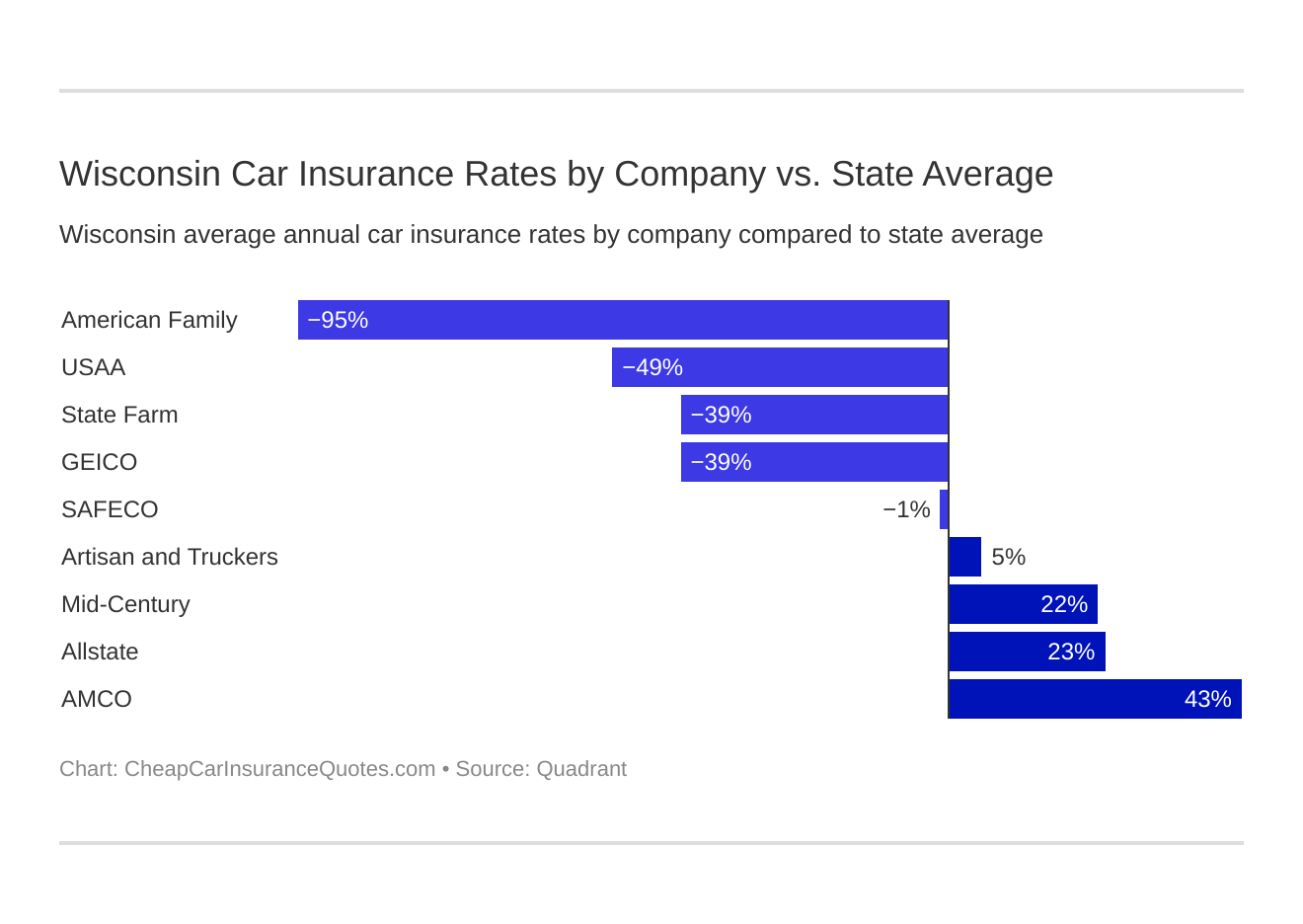

Who is the cheapest car insurance company in WI? Review the average auto insurance rates by company below:

How Much Car Insurance Costs in Wisconsin

| Car Insurance Cost in Wisconsin by City | |

|---|---|

| Columbus, WI | Sauk City, WI |

| Germantown, WI | Shullsburg, WI |

| Hillsboro, WI | Vesper, WI |

| Mikana, WI |

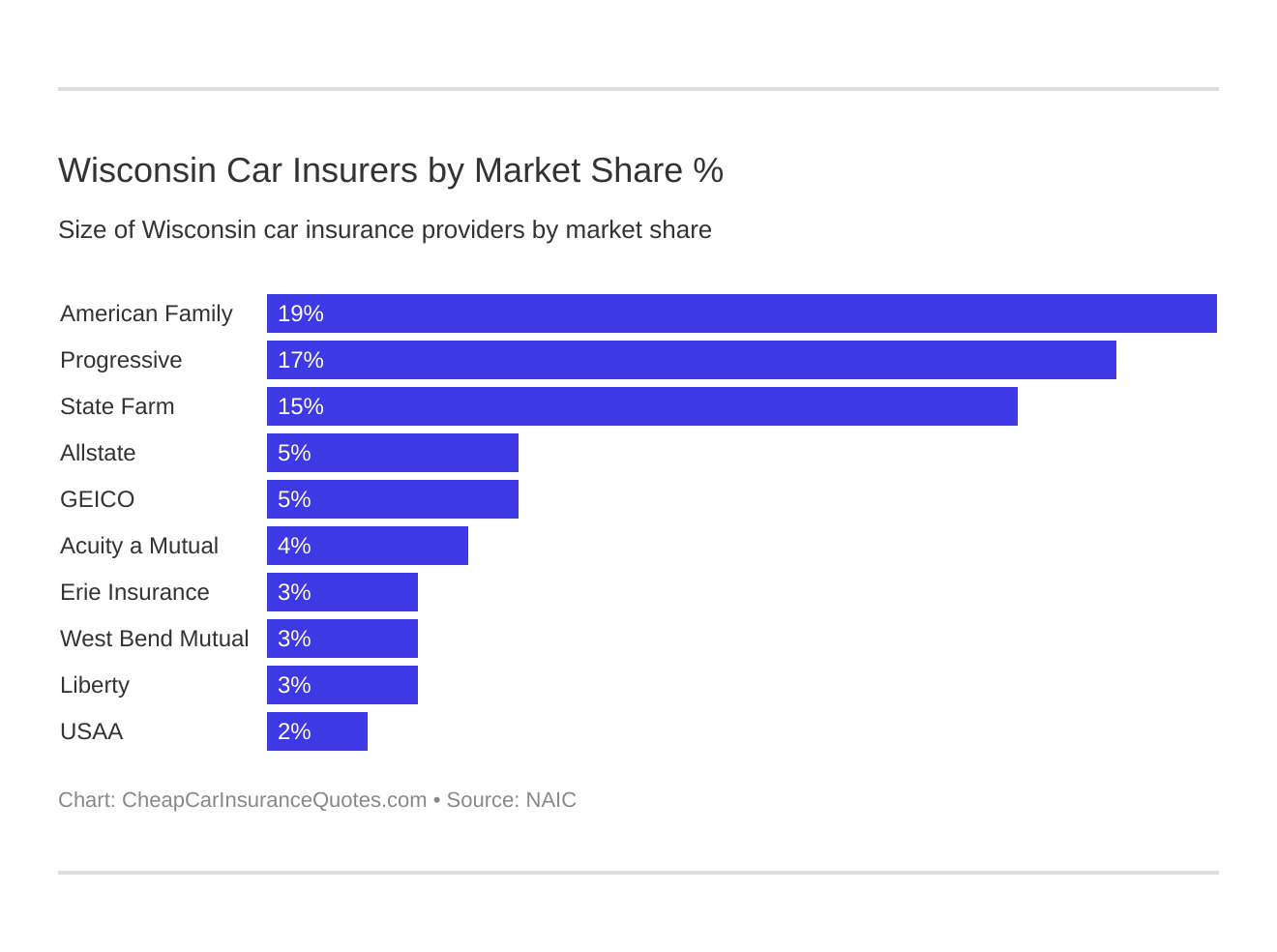

Who are the largest auto insurance companies in WI?

Start with our car insurance guide here and learn about the types of coverage, how policy deductibles work and many common questions to assist in your car insurance comparison search.

Enter your zip code below to get FREE car insurance quotes today!

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Brad Larsen

Licensed Auto Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.