Rhode Island Car Insurance

Rhode Island car insurance is relatively expensive at $167/mo, or $2,004/yr. This is 40.4 percent higher than the national average. The penalties for driving without car insurance in Rhode Island can be severe. Rhode Island auto insurance laws require all vehicles to maintain minimum levels of liability insurance. Compare Rhode Island car insurance quotes here to find affordable coverage. Enter your ZIP code below to get started.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larsen

Licensed Auto Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Auto Insurance Agent

UPDATED: Feb 16, 2024

It’s all about you. We want to help you make the right cheap car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare cheap car insurance quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Feb 16, 2024

It’s all about you. We want to help you make the right cheap car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare cheap car insurance quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Rhode Island drivers have to carry car insurance and the penalties for driving with no car insurance in Rhode Island can be severe. Not only can drivers be subject to great personal liability but also run the risk of having their driving privileges suspended along with heavy fines.

Rhode Island Car Insurance Laws

Rhode Island car insurance laws require all vehicles to maintain minimum levels of liability insurance. In 2010 the State of Rhode Island’s minimum liability auto insurance requirements for all vehicles registered in the State are:

- $25,000 liability coverage for bodily injury per person per accident

- $50,000 liability insurance for bodily injury to all persons per accident

- $25,000 of property damage liability insurance

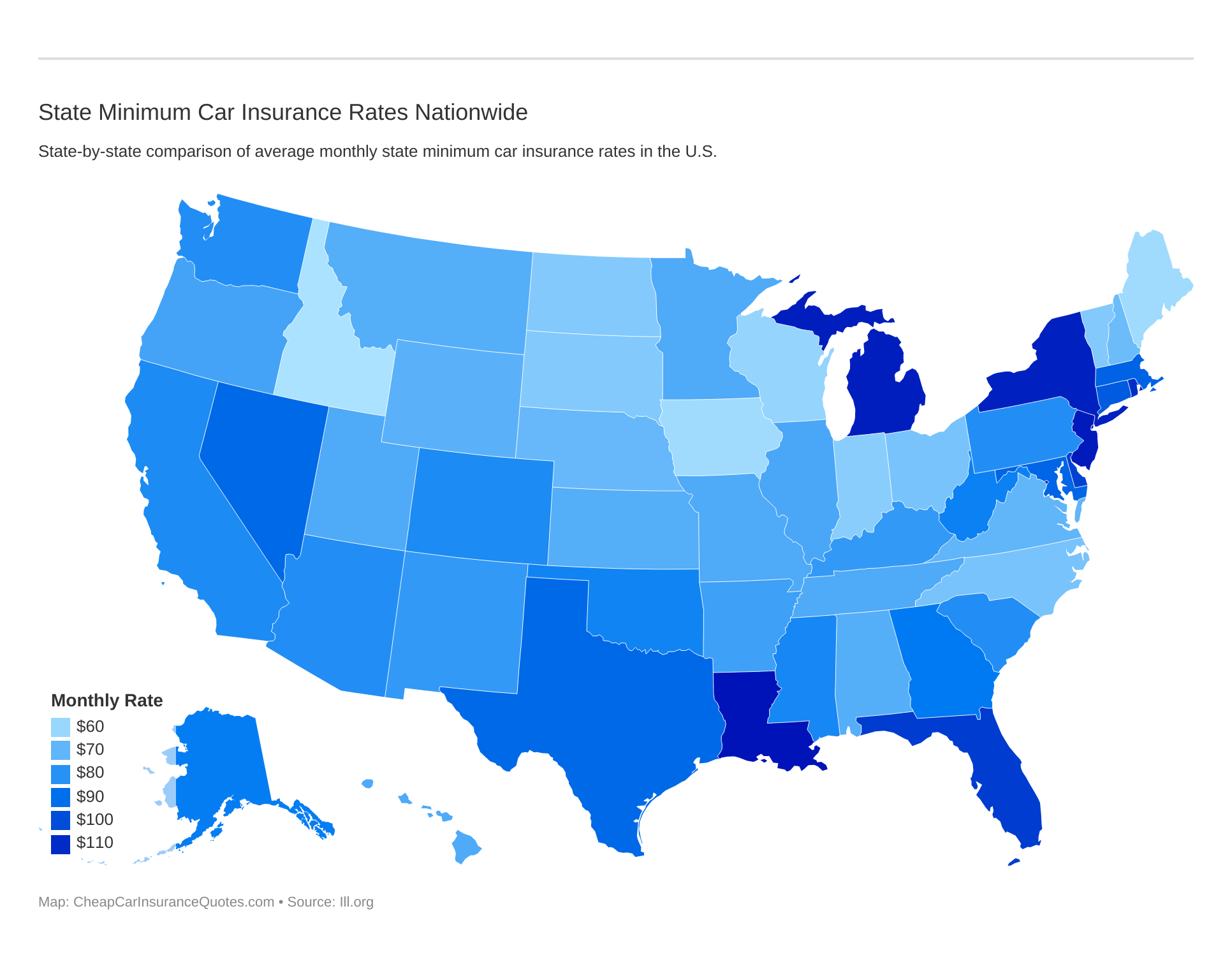

State minimum auto insurance rates and requirements vary from state to state. Compare state to state below:

Rhode Island drivers are also subject to tort law which means you can be sued for damages and do not have the protection from litigation States with no-fault car insurance laws provide. This results in great additional exposure to personal liability for drivers without sufficient insurance coverage.

While Rhode Island minimum auto insurance requirements do provide some form of protection for accidents (where it was determined you were at-fault) they certainly do not provide very much financial protection for any type of accident which involves medical bills and other damages outside of minor vehicle damage. Most Rhode Island drivers opt for limits well above state minimum requirements and even choose additional types of coverage such as collision and comprehensive for a well rounded auto insurance policy.

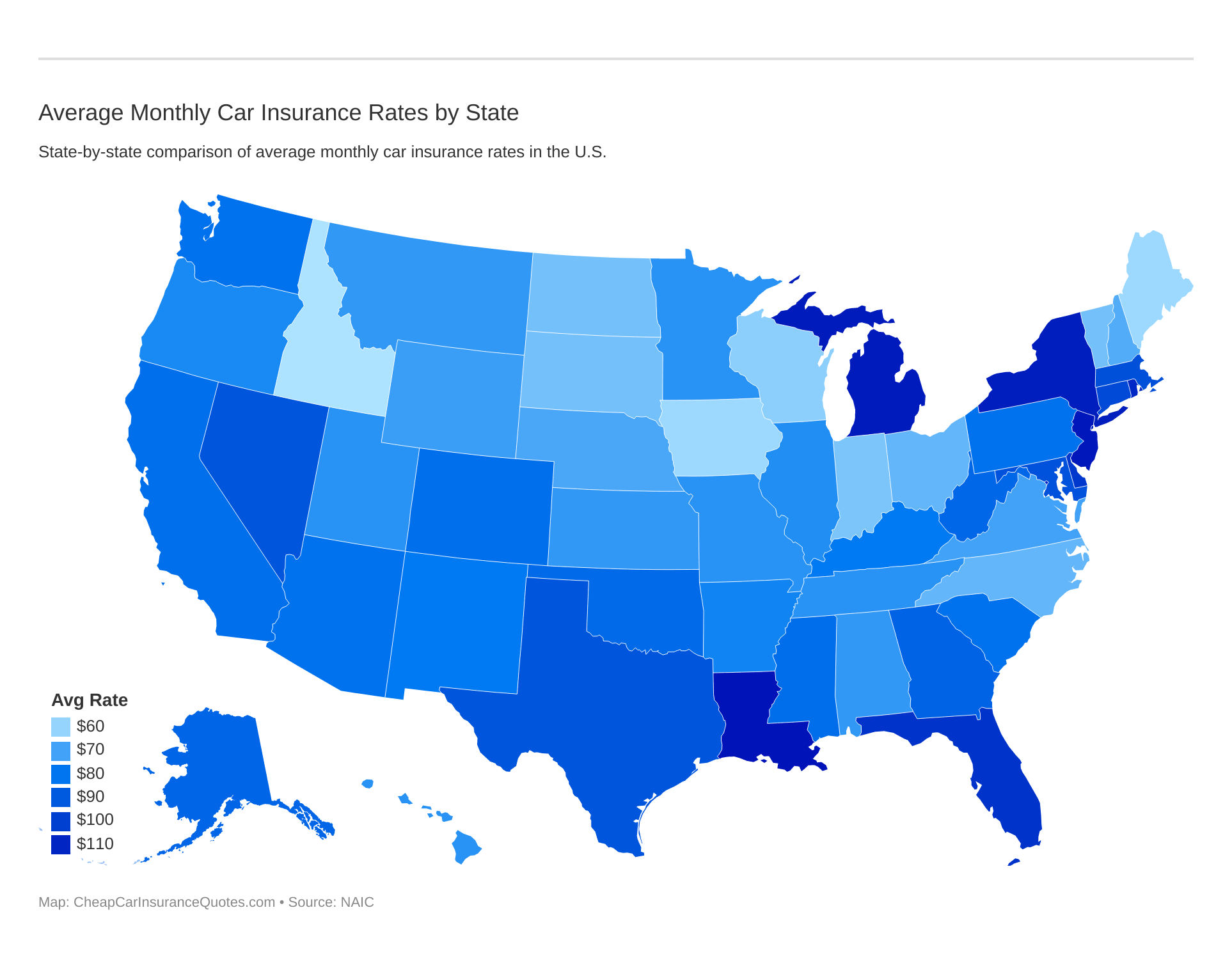

Your average monthly car insurance rates may not increase as much as you might think by adding additional coverage like comprehensive. Review rates for auto insurance coverage below:

Can I get car insurance in Rhode Island as a High Risk Driver?

Many drivers are classified as high risk by car insurance companies. While the obvious set of high risk drivers are those convicted of a DUI, convicted of driving with no car insurance in an auto accident or those with a reckless driving record there are still other reasons why any driver can be denied coverage through the voluntary market. Since auto insurance is required by law the state is also obligated to ensure people have access to purchasing automobile insurance. All states have some form of high risk insurance program to assist drivers in obtaining coverage who have been denied insurance in the voluntary market. In Rhode Island a program exists called the “Rhode Island Automobile Insurance Plan (RIAP) where the State mandates a car insurer to provide coverage. Of course drivers should never expect to get cheap car insurance quotes as a high risk driver but if you do find yourself getting denied coverage in the voluntary market then it’s a good idea to contact the Rhode Island Insurance Plan about your options.

Rhode Island Car Insurance Quotes

Car insurance comparison is the best method to find the cheapest car insurance quotes but you also need to know how to compare auto insurance companies. Start with our auto insurance guide, learn about car insurance discounts, compare auto insurance company reviews and (when you’re ready) always request quotes from multiple providers.

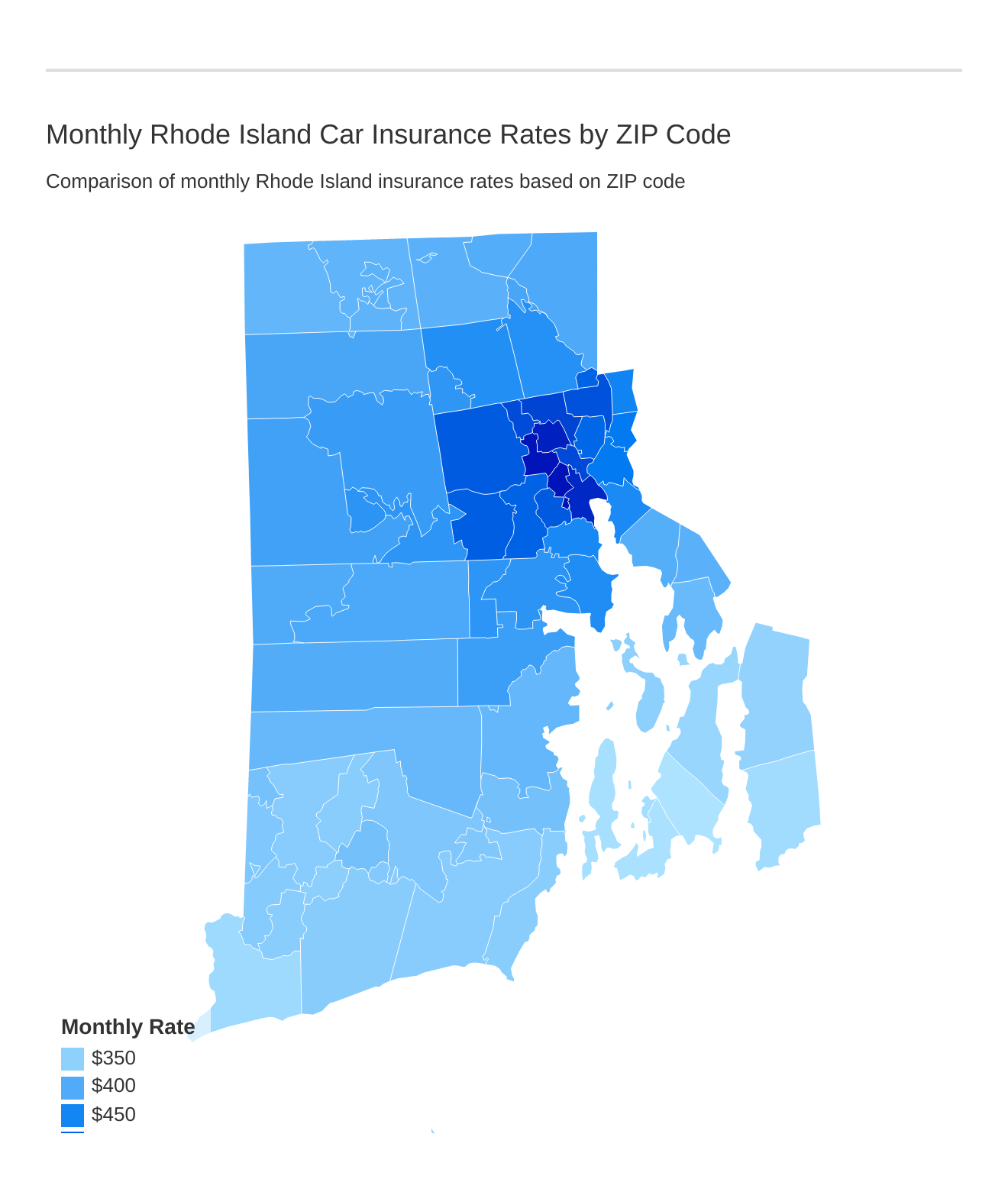

ZIP codes affect auto insurance because of factors like traffic, crime to name a few. Find out how your ZIP code stacks up in RI.

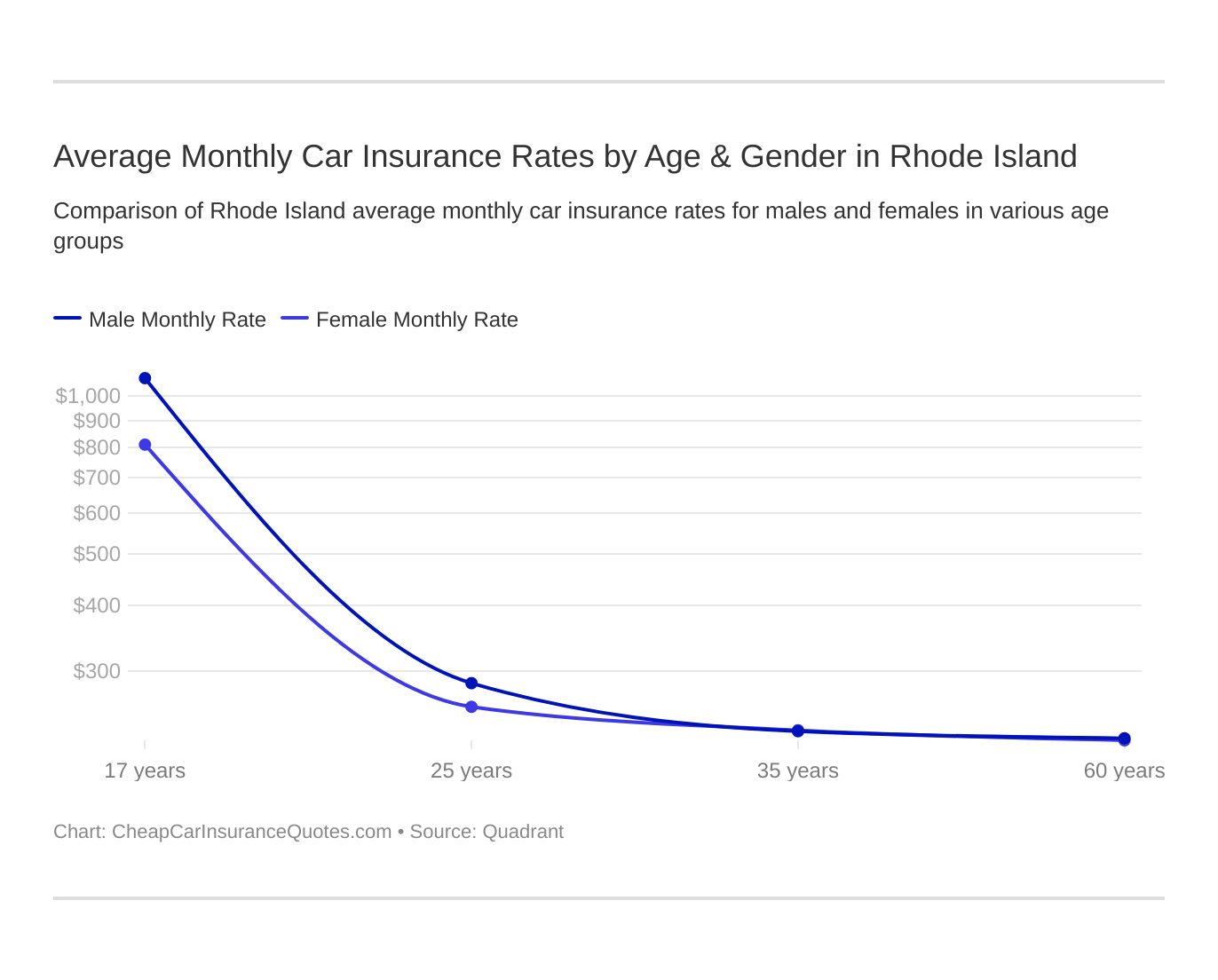

Gender and age will affect your auto insurance. Younger drivers are often in a higher risk class. See if the gender stereotype (males vs female car insurance rates) holds true in RI.

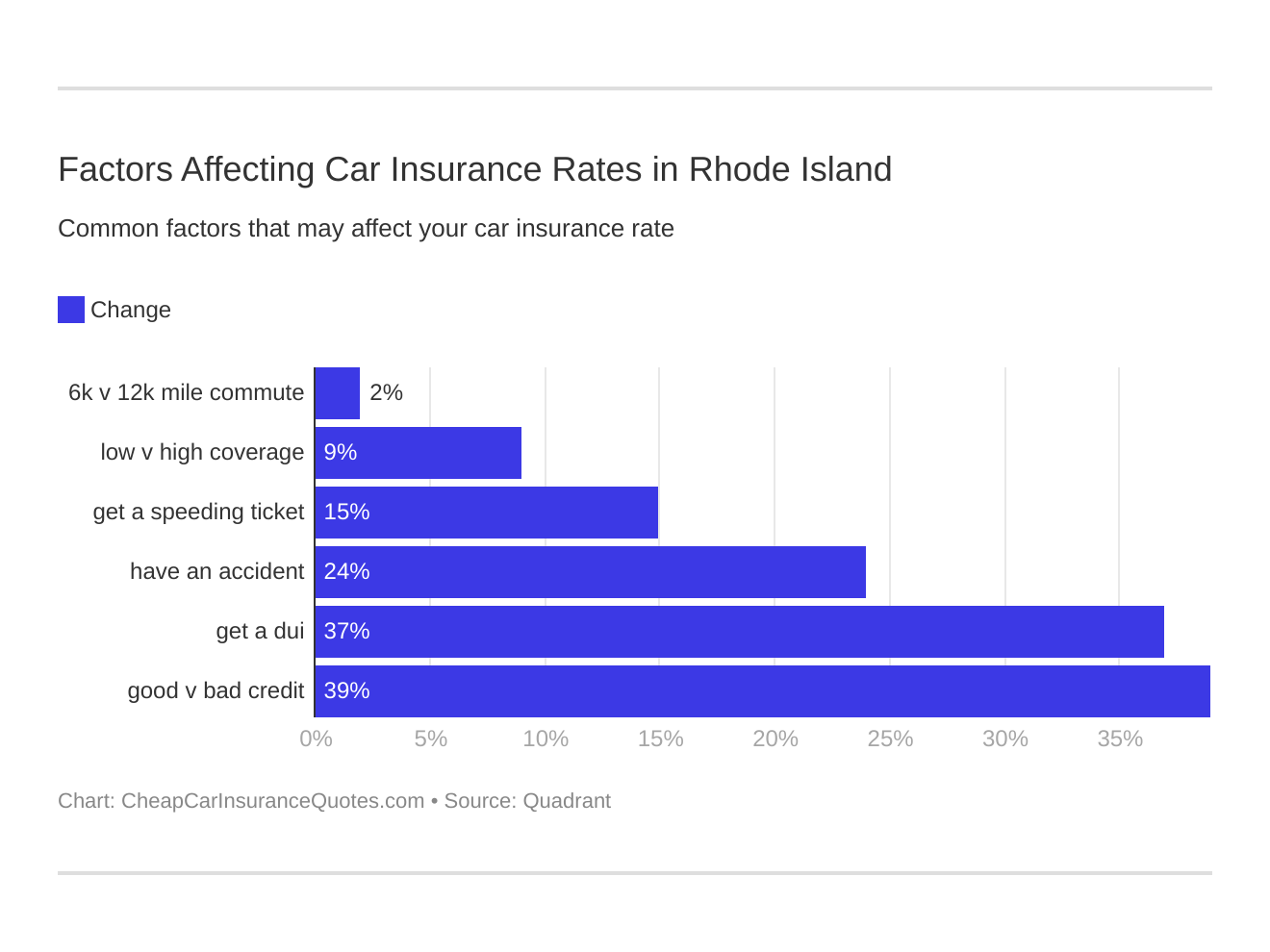

Six major factors affect car insurance rates in Rhode Island. Which auto insurance factors will affect rates the most? Find out below:

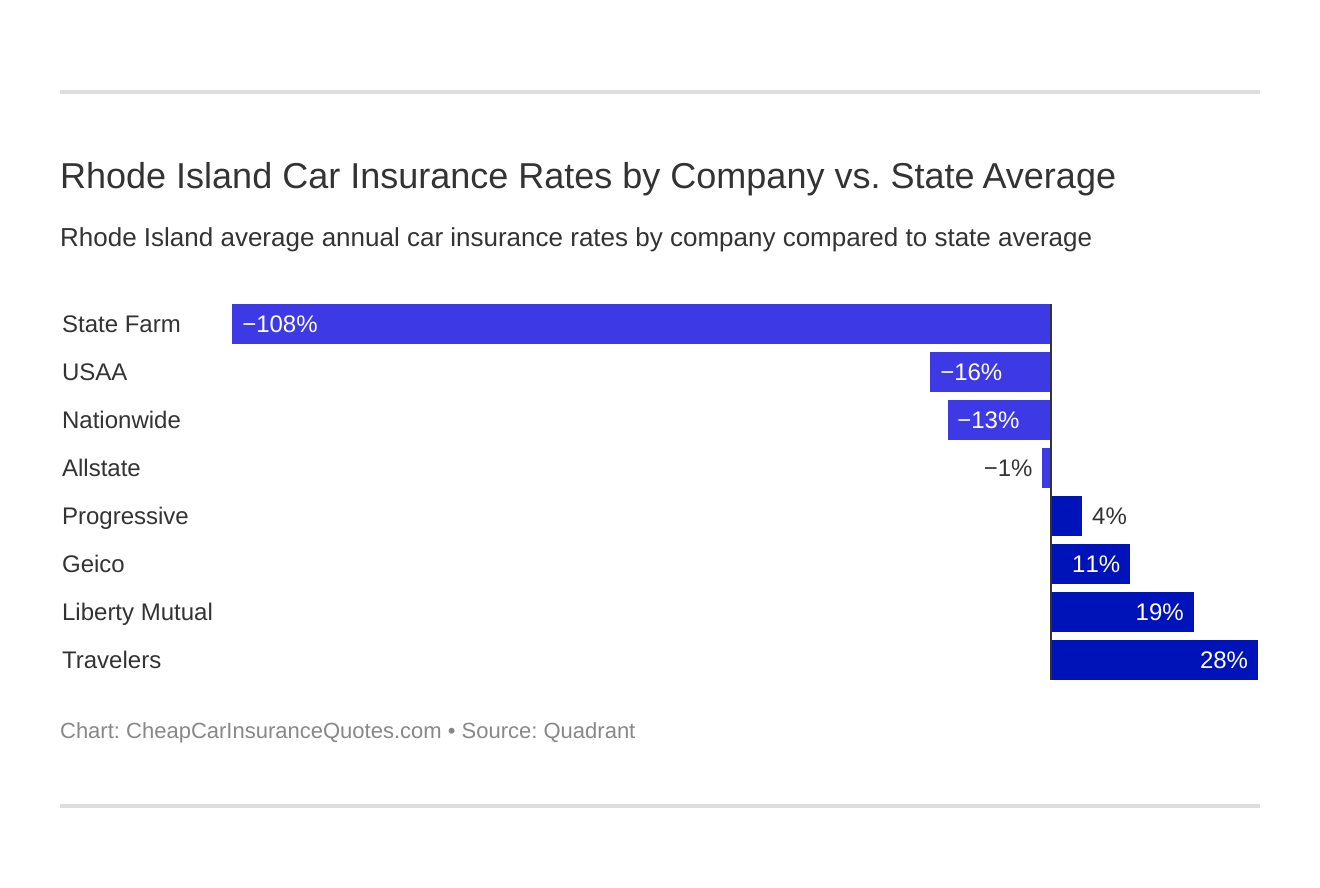

Now let’s see who is the cheapest car insurance company in Rhode Island.

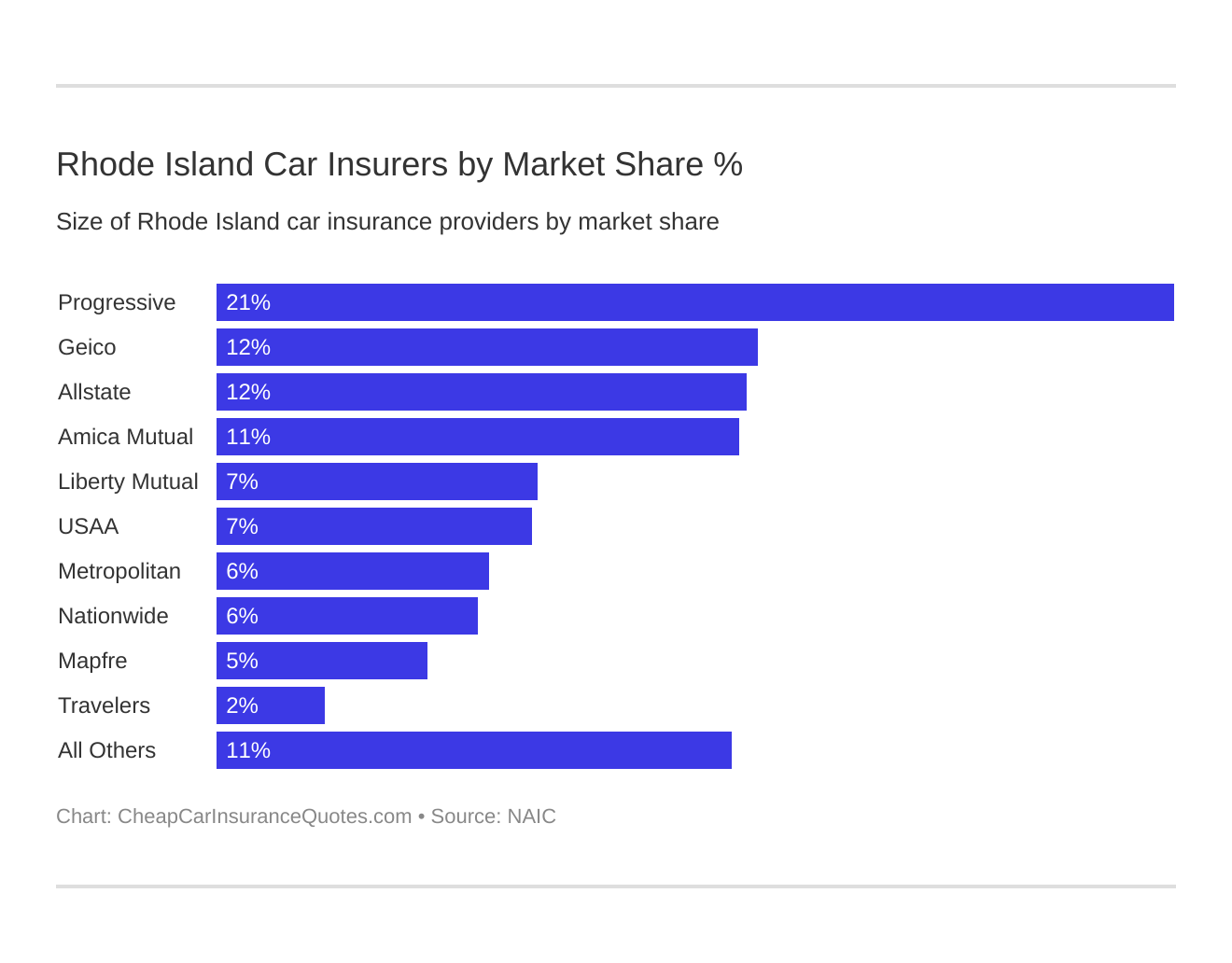

Who are the largest car insurance companies in Rhode Island?

Remember to compare the details of coverage before premiums as many times cheap car insurance quotes often reflect lower levels of coverage.

Compare Car Insurance Costs Across Rhode Island by City

Explore the varying car insurance rates across different cities in Rhode Island. From Exeter to Johnston, delve into the comparative costs of car insurance in these locations. Whether you’re a resident seeking the best rates or simply interested in regional differences, start comparing rates now to find the most suitable option for you.

| Car Insurance Cost in Rhode Island by City |

|---|

| Exeter, RI |

| Johnston, RI |

Get Started – Compare Auto Insurance in Rhode Island Today!

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Brad Larsen

Licensed Auto Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.