Alabama Car Insurance

Alabama’s Department of Insurance sets Alabama car insurance laws and currently requires all drivers to have insurance coverage of at least 25/50/25 in minimum liability. Alabama auto insurance requirements are higher than most states, but these limits are still not high enough to prevent you from personal responsibility in many more serious car accidents. Alabama car insurance costs average at $113/mo, but you can find cheaper rates online with our free comparison tool. Enter your ZIP code above to get started.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larsen

Licensed Auto Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Auto Insurance Agent

UPDATED: Feb 16, 2024

It’s all about you. We want to help you make the right cheap car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare cheap car insurance quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Feb 16, 2024

It’s all about you. We want to help you make the right cheap car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare cheap car insurance quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- It’s important to compare all your options and not just focus on the well-known brands

- Higher limits are available through most Alabama auto insurance companies for a nominal fee

- Car insurance rates can vary significantly from one car insurer to another

Alabama car insurance laws require all drivers to carry auto insurance coverage which meets or exceed state minimum requirements.

Current Alabama car insurance laws require all vehicles to carry minimum levels of liability insurance coverage.

Enter your zip code above to get FREE car insurance quotes today!

Alabama Car Insurance Requirements

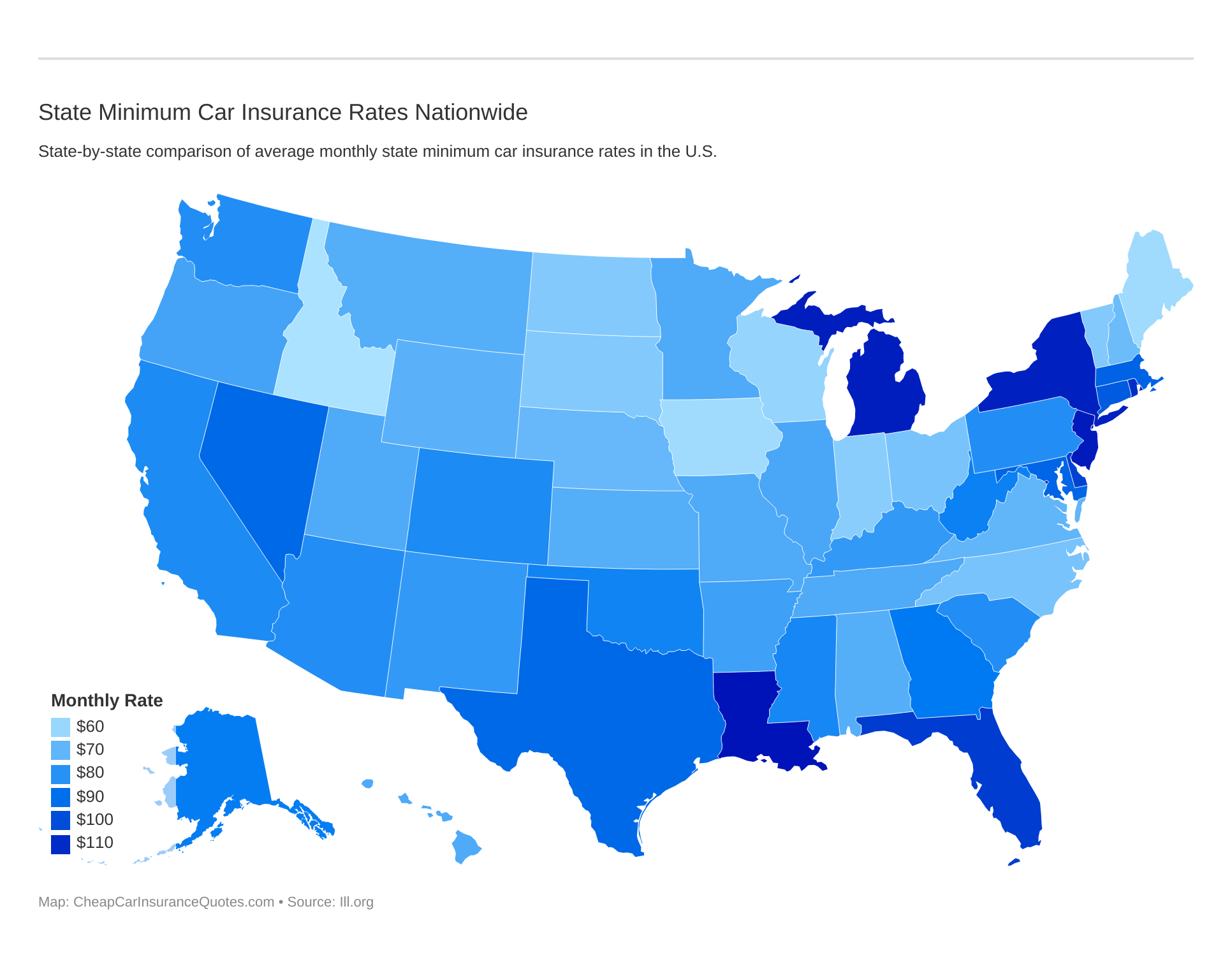

Take a look at how state minimum car insurance rates vary from state to state.

Alabama’s Department of Insurance sets Alabama’s car insurance laws and currently, require all drivers to have insurance coverage of at least 25/50/25.

These numbers represent the minimum levels of insurance for bodily injury and property damage liability insurance.

The minimum level requirements for Alabama are:

- $25,000 bodily injury liability

- $50,000 bodily injury liability

- $25,000 property damage

Alabama car insurance laws do require higher limits than most states however these limits are still not high enough to prevent you from personal responsibility in many medium to serious car accidents.

Higher limits are available through most Alabama auto insurance companies for a nominal fee.

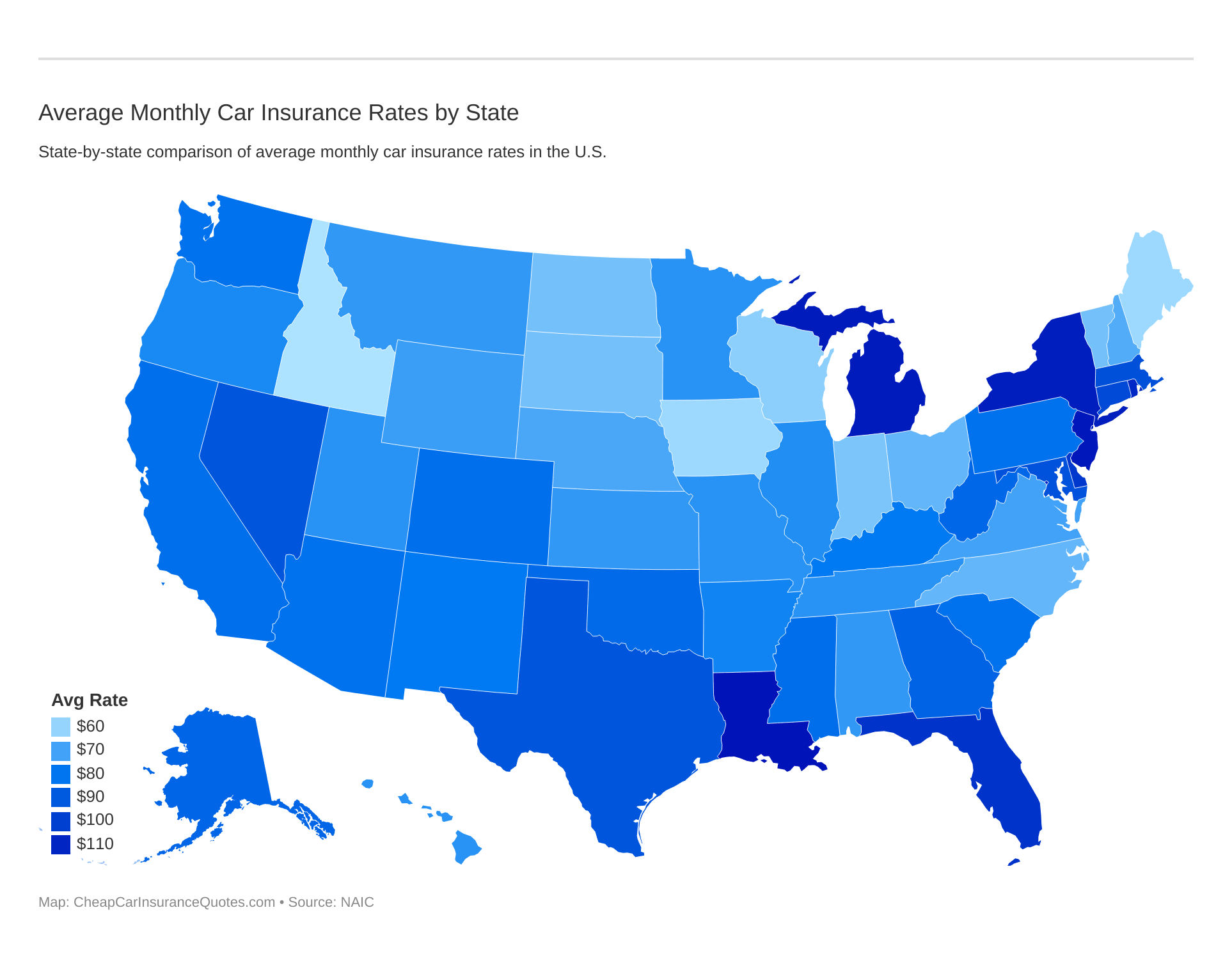

Let’s take a look at the average monthly car insurance rates.

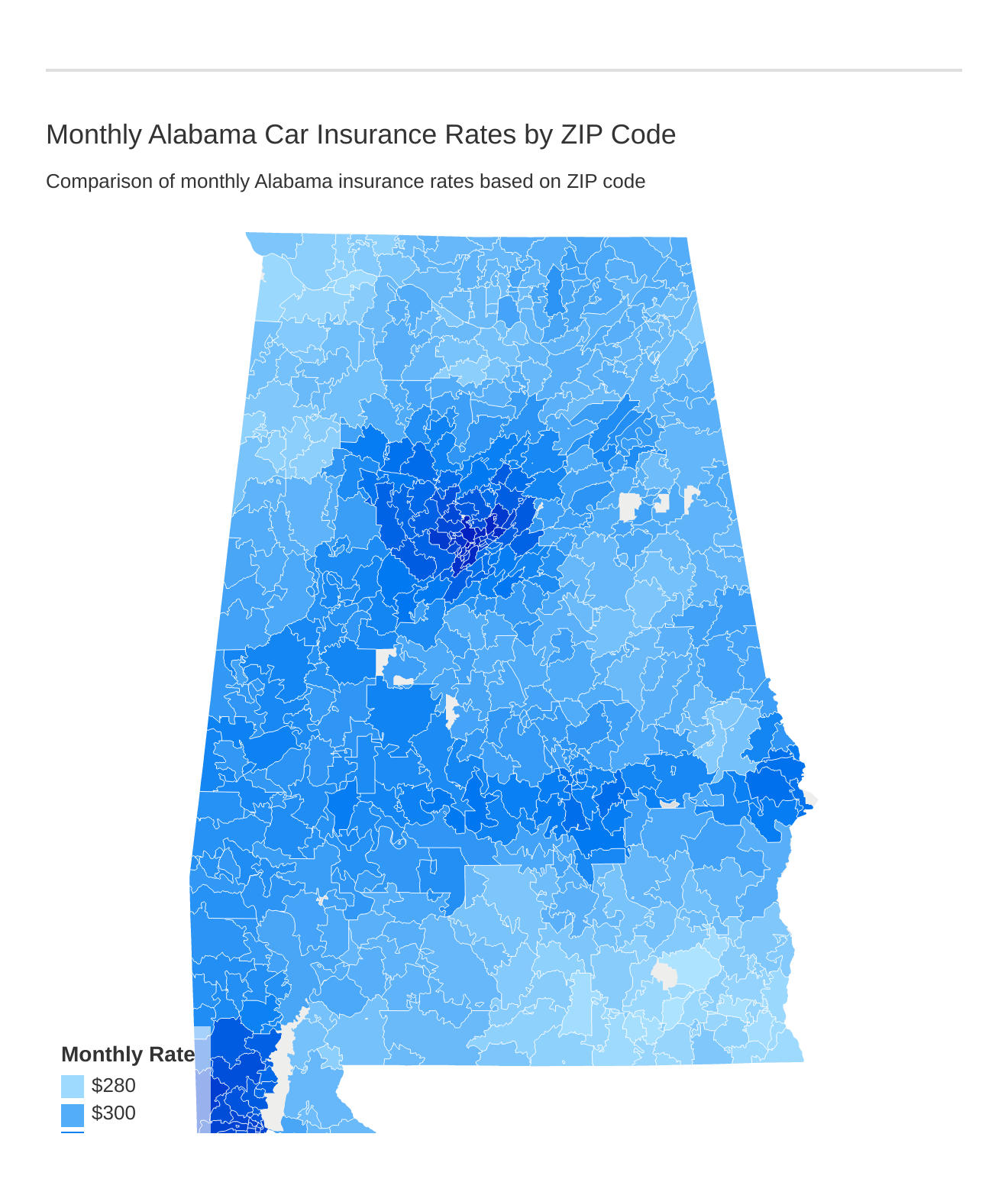

Let’s take a closer look at how ZIP codes affect car insurance in Alabama.

- Alabama

- Cheap Quotes for Scottsboro, AL Car Insurance (2025)

- Cheap Quotes for Opelika, AL Car Insurance (2025)

- Cheap Quotes for Linden, AL Car Insurance (2025)

- Cheap Quotes for Haleyville, AL Car Insurance (2025)

- Cheap Quotes for Glen Allen, AL Car Insurance (2025)

- Cheap Quotes for Eufaula, AL Car Insurance (2025)

- Cheap Quotes for Chatom, AL Car Insurance (2025)

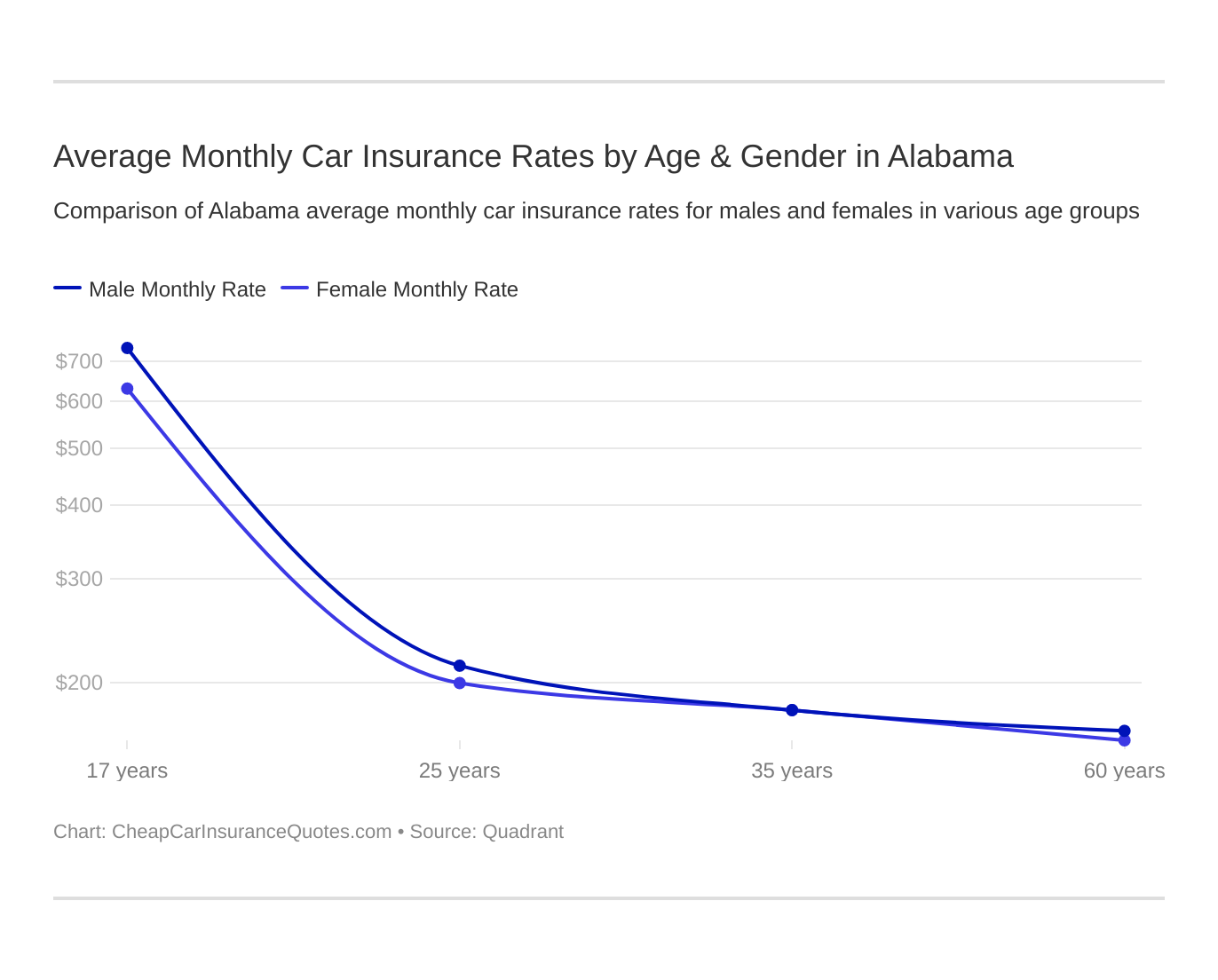

Age and gender will affect your car insurance. Younger drivers are often in a high risk class. See if the gender stereotype (males pay more) holds true in AL.

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

How many car insurance companies are there in Alabama?

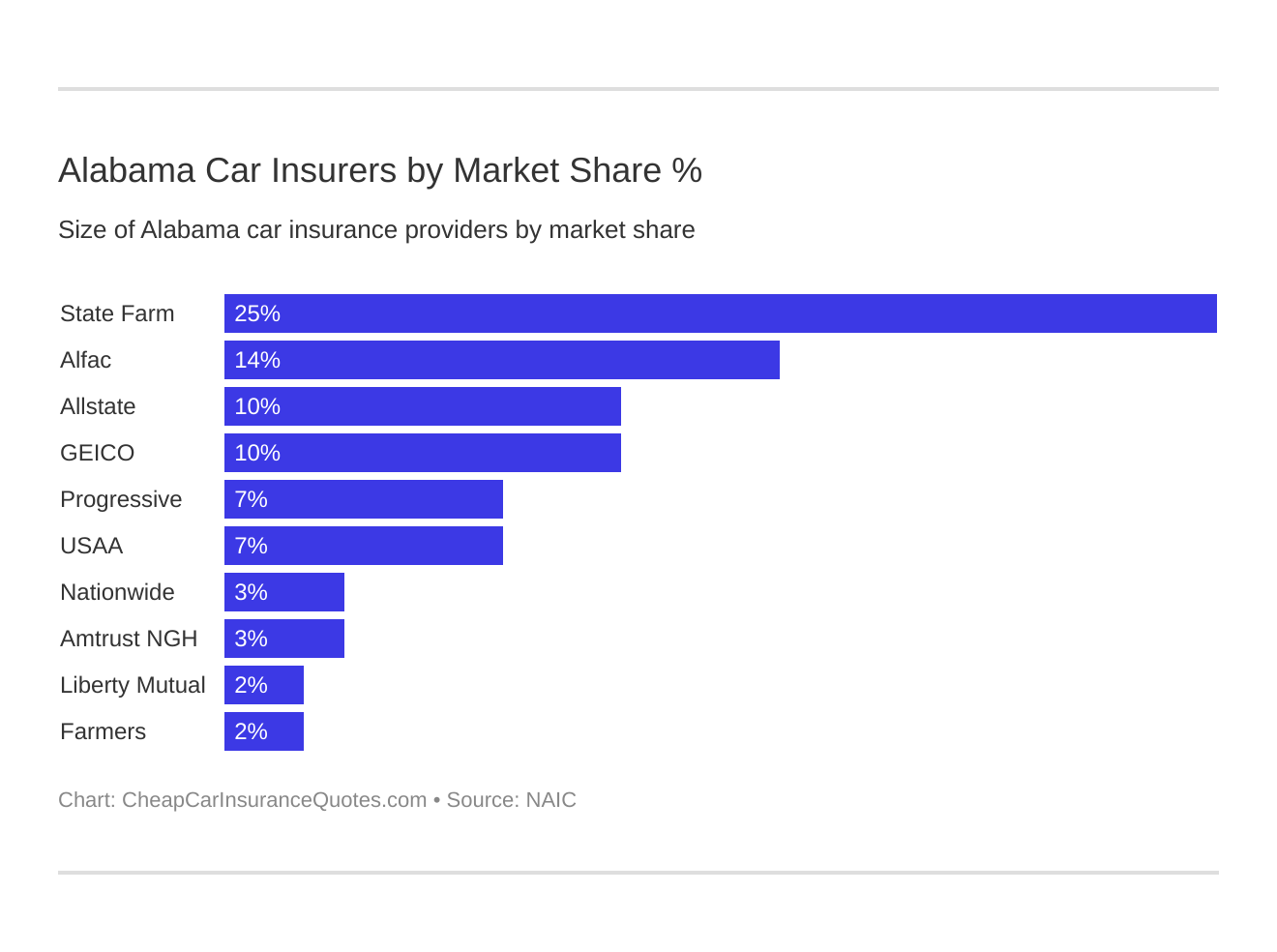

Alabama enjoys a very competitive car insurance market with many of the national auto insurance companies offering policy coverage to Alabama residents.

Some of the well-known brands include Allstate, Geico, and State Farm but Alabama also has some local car insurers who also provide competitive auto insurance policies.

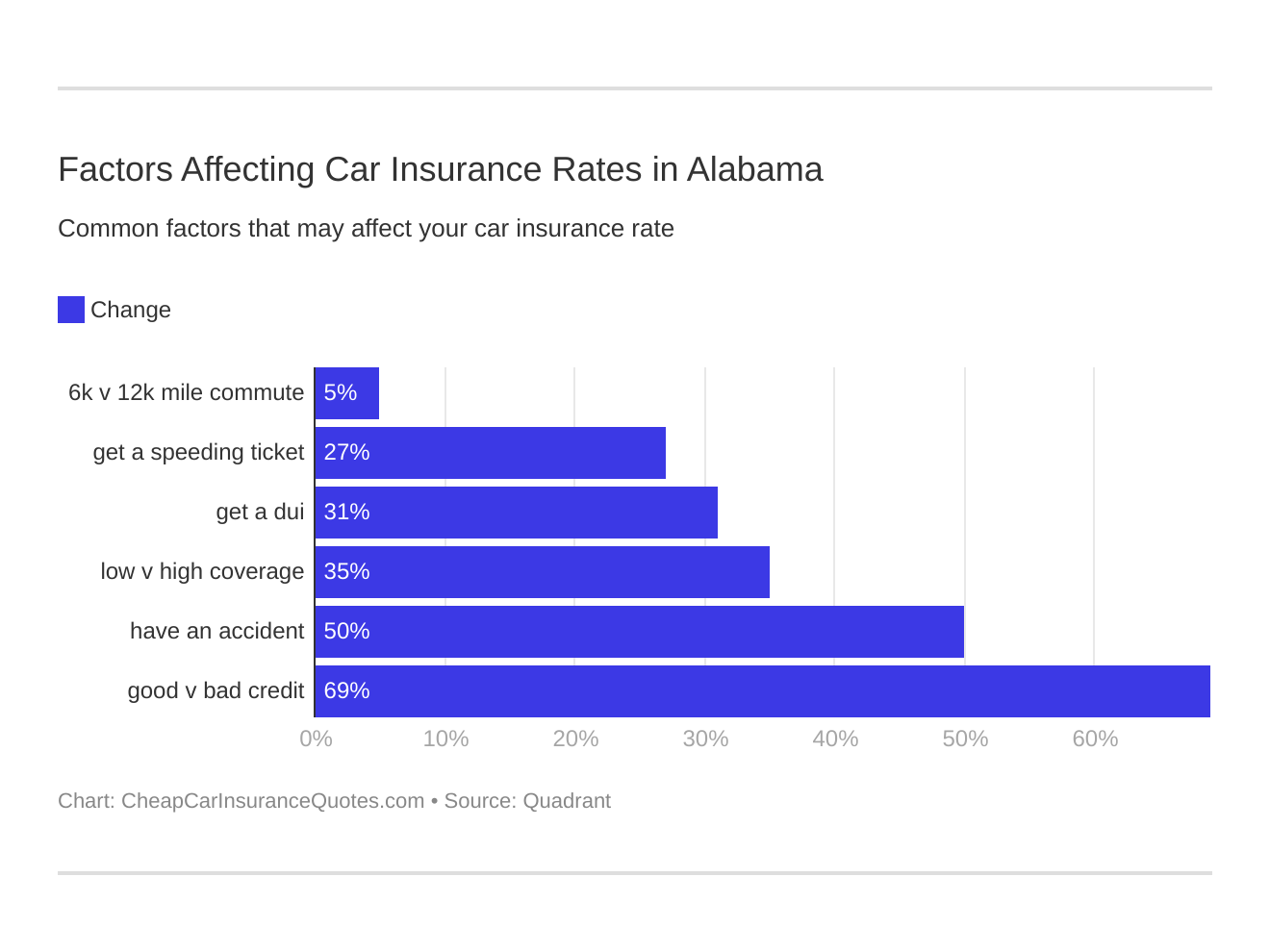

Take a look at these 6 major factors affecting auto insurance rates in Alabama.

Car insurance rates can vary significantly from one car insurer to another, but there are some things you can do to help find the best available coverage.

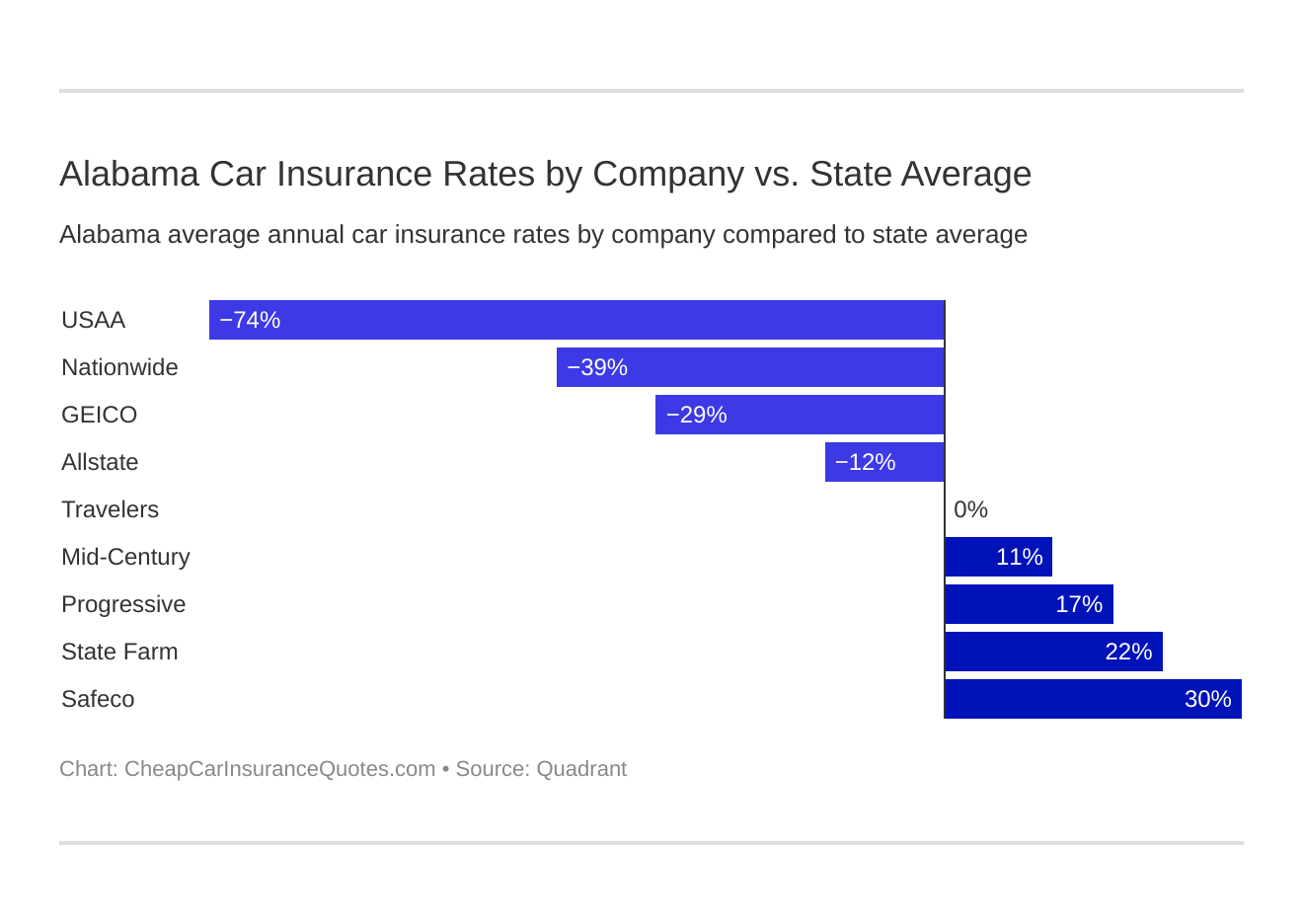

Now let’s see who is the cheapest car insurance company in Alabama.

Unveiling Car Insurance Costs in Alabama by City

Explore the varying car insurance costs across different cities in Alabama. Delve into the rates in Chatom, Linden, Eufaula, Opelika, Glen Allen, and Scottsboro, revealing the disparities that exist among these locations. Gain insights into the factors influencing these differences and make informed decisions regarding your car insurance coverage.

| Car Insurance Cost in Alabama by City | |

|---|---|

| Chatom, AL | Linden, AL |

| Eufaula, AL | Opelika, AL |

| Glen Allen, AL | Scottsboro, AL |

| Haleyville, AL |

Here’s what you can do:

- Understand the types of car coverage, how car insurance discounts work and what policy limits are.

- Never compare potential providers by just premiums. Always review the details of coverage

- Still, compare some car insurance companies

- Pay particular attention to policy limits and realize sometimes lower car insurance rates mean less coverage. Try to avoid being underinsured.

Who are the largest car insurance companies in Alabama?

Car insurance is required by law however it’s not mandatory to pay high premiums. The more you learn about car insurance, the more you can save – now, and every time you buy a car.

Car insurance comparison between potential car insurers is the only way you will ever find the best car insurance rates.

Enter your zip code below to get FREE car insurance quotes today!

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Brad Larsen

Licensed Auto Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.