Montana Car Insurance

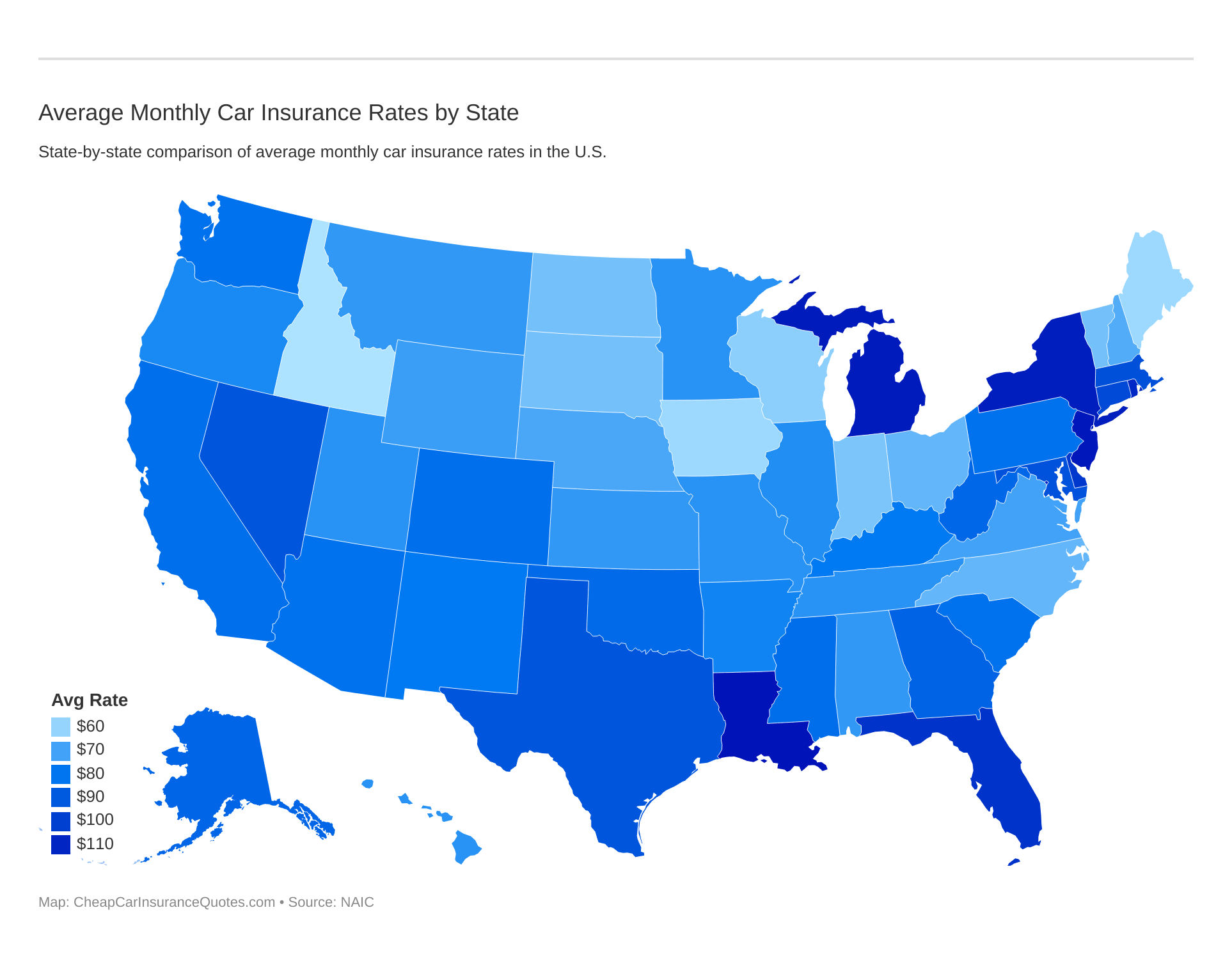

Montana car insurance rates average at $134/mo, or $1,615/yr. This is over 13 percent more than the national average. You can find cheaper coverage here with our free comparison tool below. But drivers must note that Montana auto insurance companies are required by law to inform and offer drivers an option to purchase uninsured motorist (UIM) auto insurance. This additional coverage can raise your rates, so start comparing Montana car insurance quotes for free to find the best rates for you.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larsen

Licensed Auto Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Auto Insurance Agent

UPDATED: Nov 27, 2023

It’s all about you. We want to help you make the right cheap car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare cheap car insurance quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Nov 27, 2023

It’s all about you. We want to help you make the right cheap car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare cheap car insurance quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Montana car insurance laws are set by the MT Commissioner of Securities and Insurance

- Montana state laws have set minimum auto insurance requirements for all vehicles

- In Montana, Most drivers do opt to carry UIM coverage in addition to other types of insurance

Montana car insurance laws are set by the MT Commissioner of Securities and Insurance and current laws (2010) require all drivers to carry liability auto insurance for vehicles registered in the state.

If caught driving without insurance, you not only risk losing your license, but you may also have to pay hefty fines.

Ready to compare car insurance quotes in Montana? Enter your zip code above and start comparing for FREE!

Montana Car Insurance Requirements

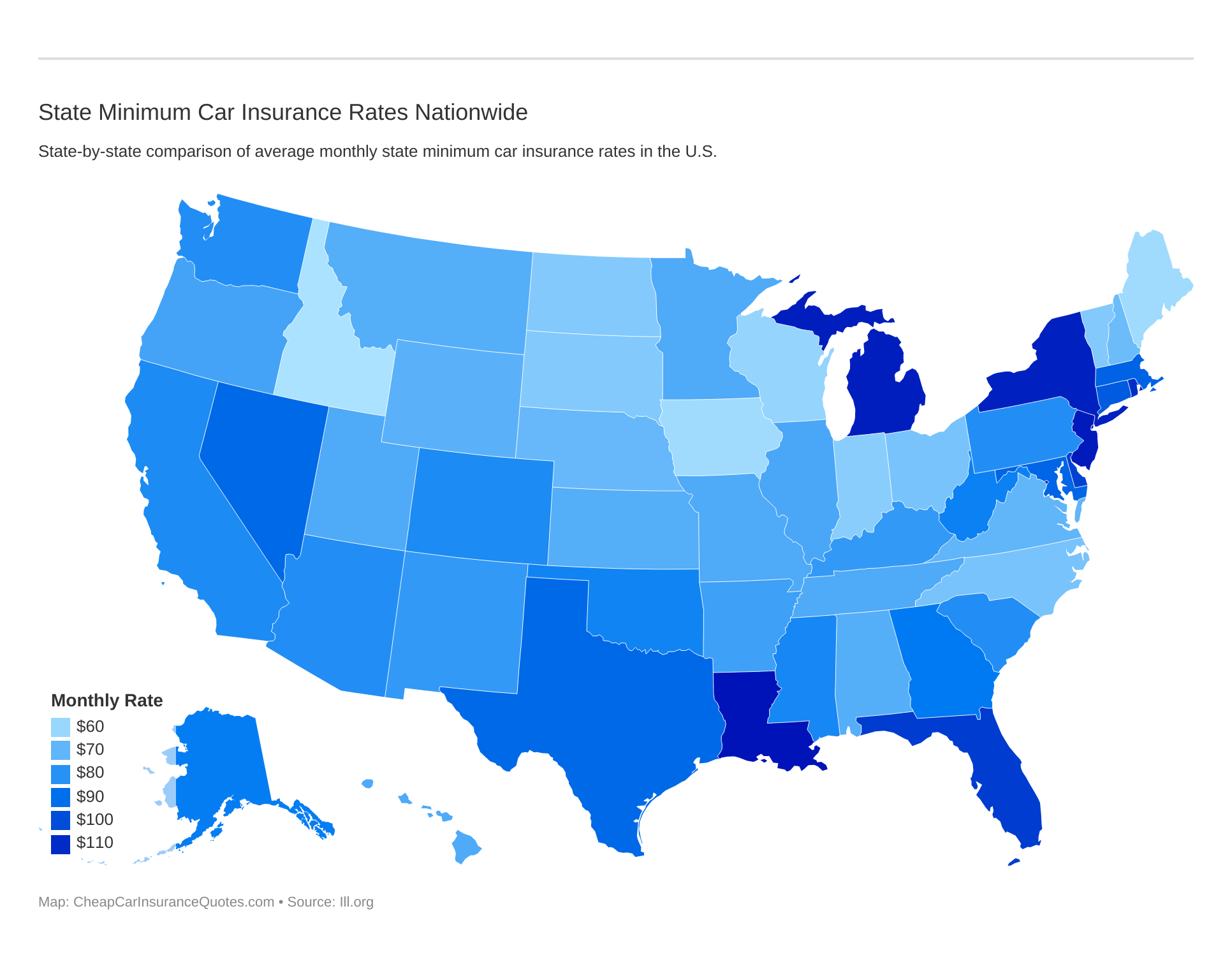

Take a look at how state minimum car insurance rates vary from state to state.

Montana state laws have set minimum auto insurance requirements for all vehicles, however, the minimum car insurance coverage required only includes liability insurance.

In order to stay compliant with Montana car insurance laws you must have at least:

- $25,000 bodily injury liability insurance per person per accident

- $50,000 bodily injury liability insurance per accident

- $10,000 property damage insurance

Montana car insurance companies are also required by law to inform and offer drivers an option to purchase UIM auto insurance, however, the choice whether or not to buy UIM insurance coverage is entirely optional.

Most drivers do opt to carry UIM coverage in addition to other types of insurance.

Consider if you get into an accident and both vehicles suffer $5,000 in damage.

Your liability insurance will cover damages to the other vehicle, however, the $5,000 damage to your vehicle you actually have no coverage for and must pay out-of-pocket.

Let’s take a look at the average monthly car insurance rates.

This is why you need to learn about the types of coverage and consider optional insurance such as:

- Comprehensive

- Collision

- GAP insurance

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

Montana Car Insurance Companies

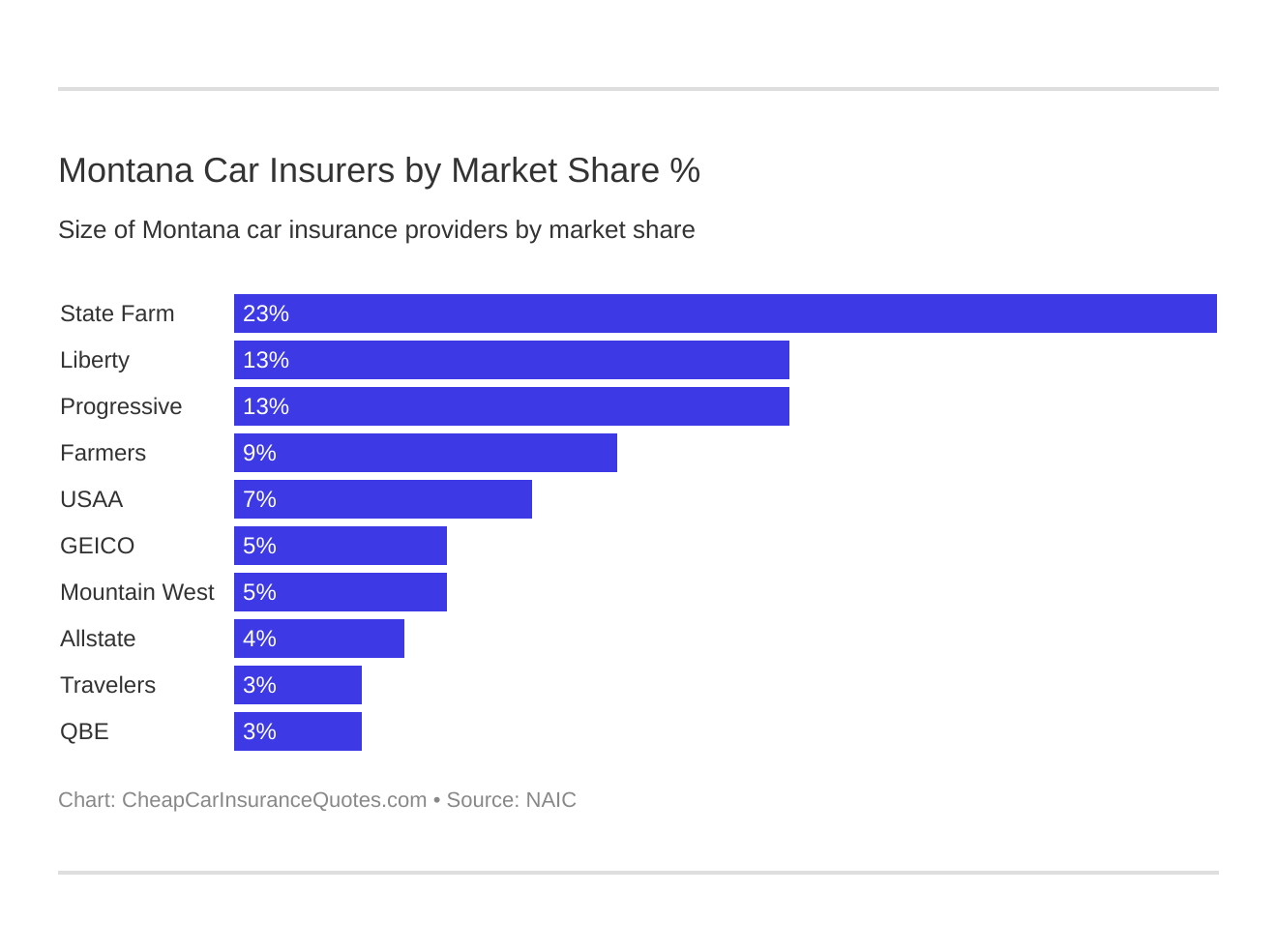

Montana has just under 100 licensed car insurance companies so it’s a fairly competitive market, however, your risk profile will determine how many car insurers provide coverage.

High-risk drivers often have a much harder time obtaining coverage than good drivers.

Almost all national brands sell coverage in Montana, but its also home to many regional providers who also have very reliable coverage at affordable rates.

A few of the more popular Montana auto insurance companies are:

- Farmers

- Geico

- Allstate

- American Bankers

- California Casualty

- Progressive

- State Farm

- Travelers

Montana Car Insurance Quotes

As with the purchase of any financial product, the only way to find the best rates will be with a solid comparison search.

While many Montana drivers simply compare auto insurance premiums, it’s critical you leave premiums as the last factor in your car insurance comparison search and make sure to compile a list of policies with equal coverage before making a final decision.

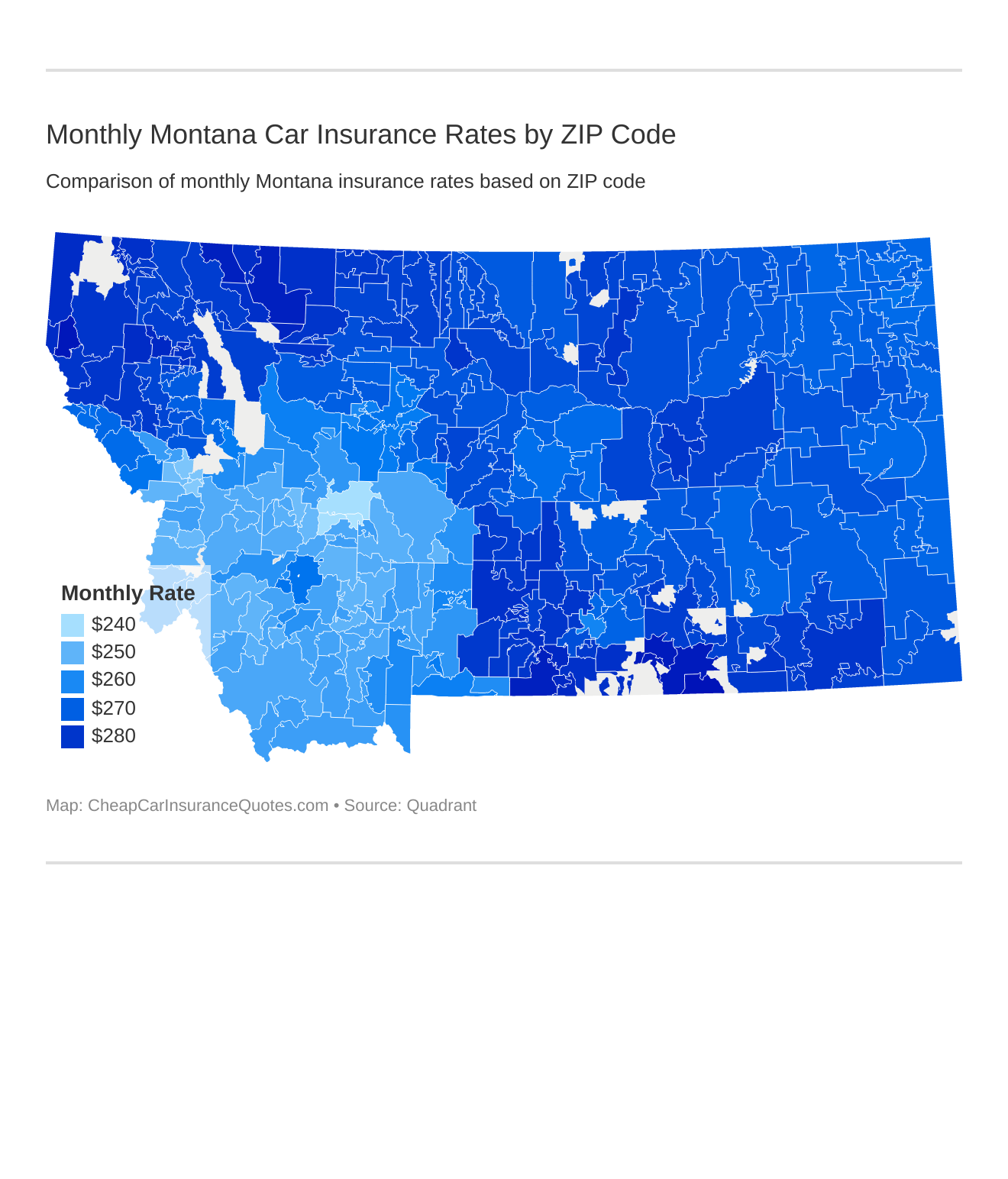

Let’s take a closer look at how ZIP codes affect car insurance in Montana.

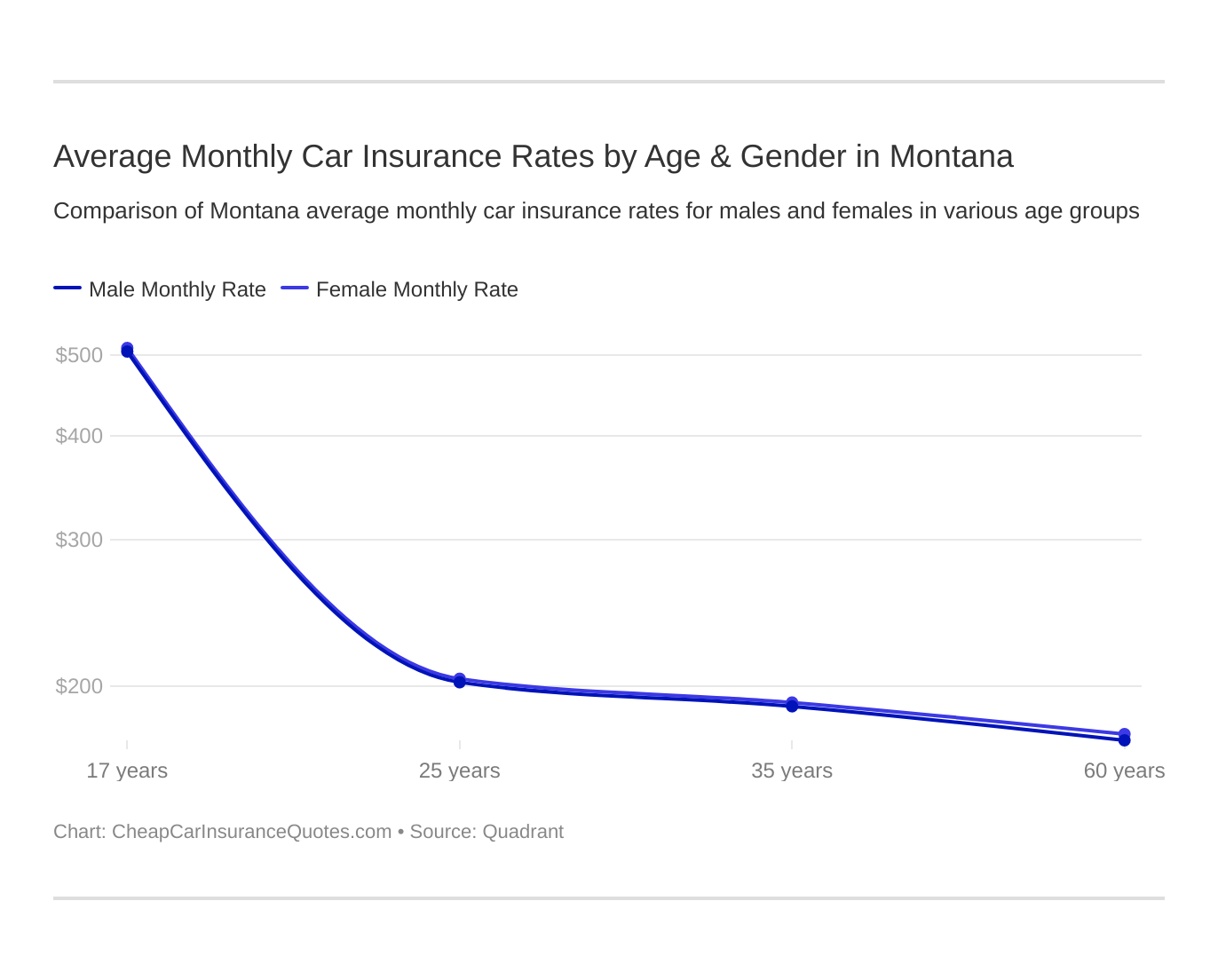

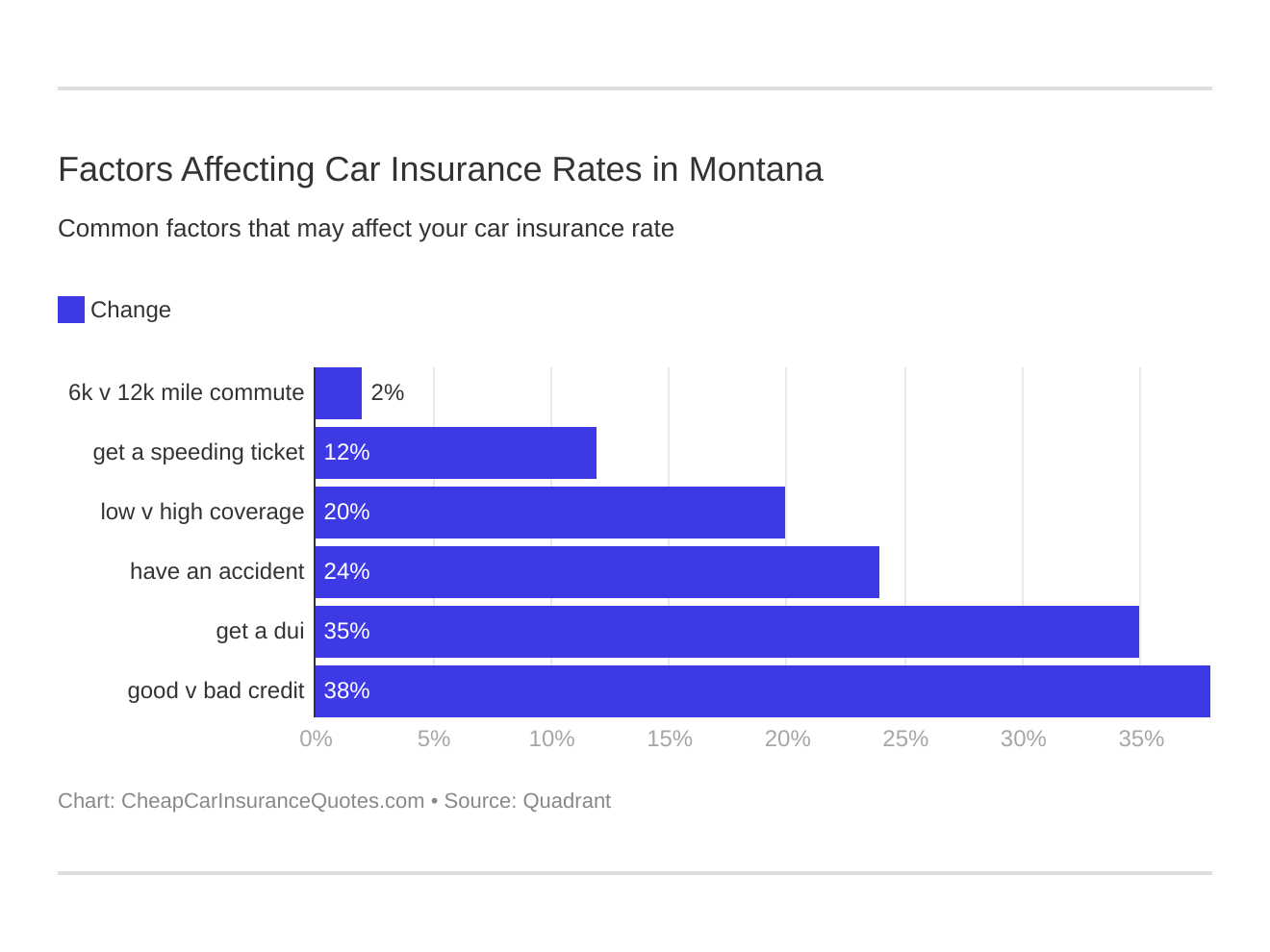

Age and gender will affect your car insurance. Younger drivers are often in a high risk class. See if the gender stereotype (males pay more) holds true in MT.

Some states have banned discrimination based on your credit score when it comes to auto insurance rates, and this is one of those States.

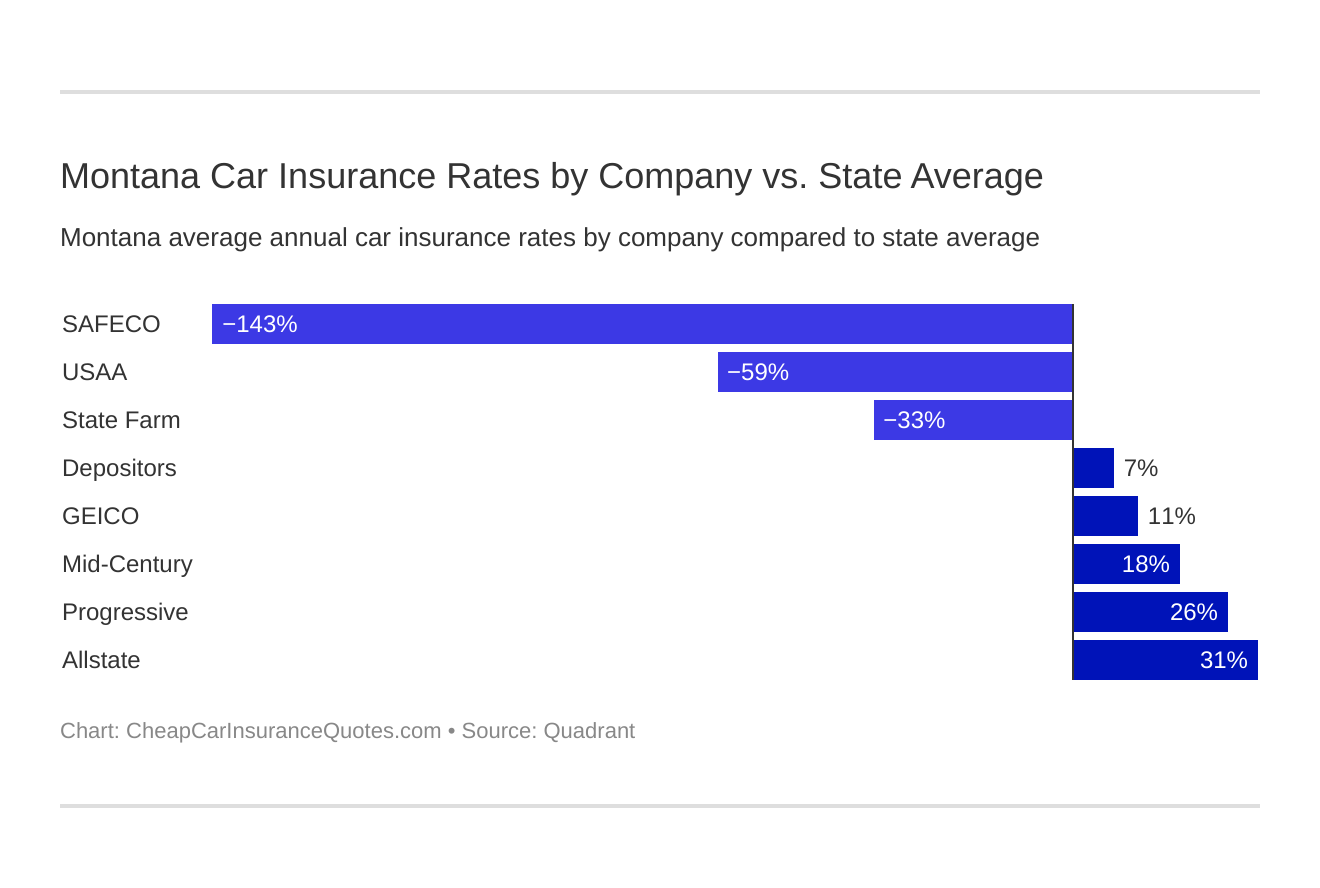

Who is the cheapest car insurance company in MT? Review the average auto insurance rates by company below:

Who are the largest auto insurance companies in MT?

Cheap car insurance quotes can often be very attractive however the purpose of auto insurance is to have coverage in the event of a claim so make sure any policy purchased incorporates all the types of coverage you need.

Compare Montana car insurance rates today! Enter your zip code below to get started for FREE!

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Brad Larsen

Licensed Auto Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.