Massachusetts Car Insurance

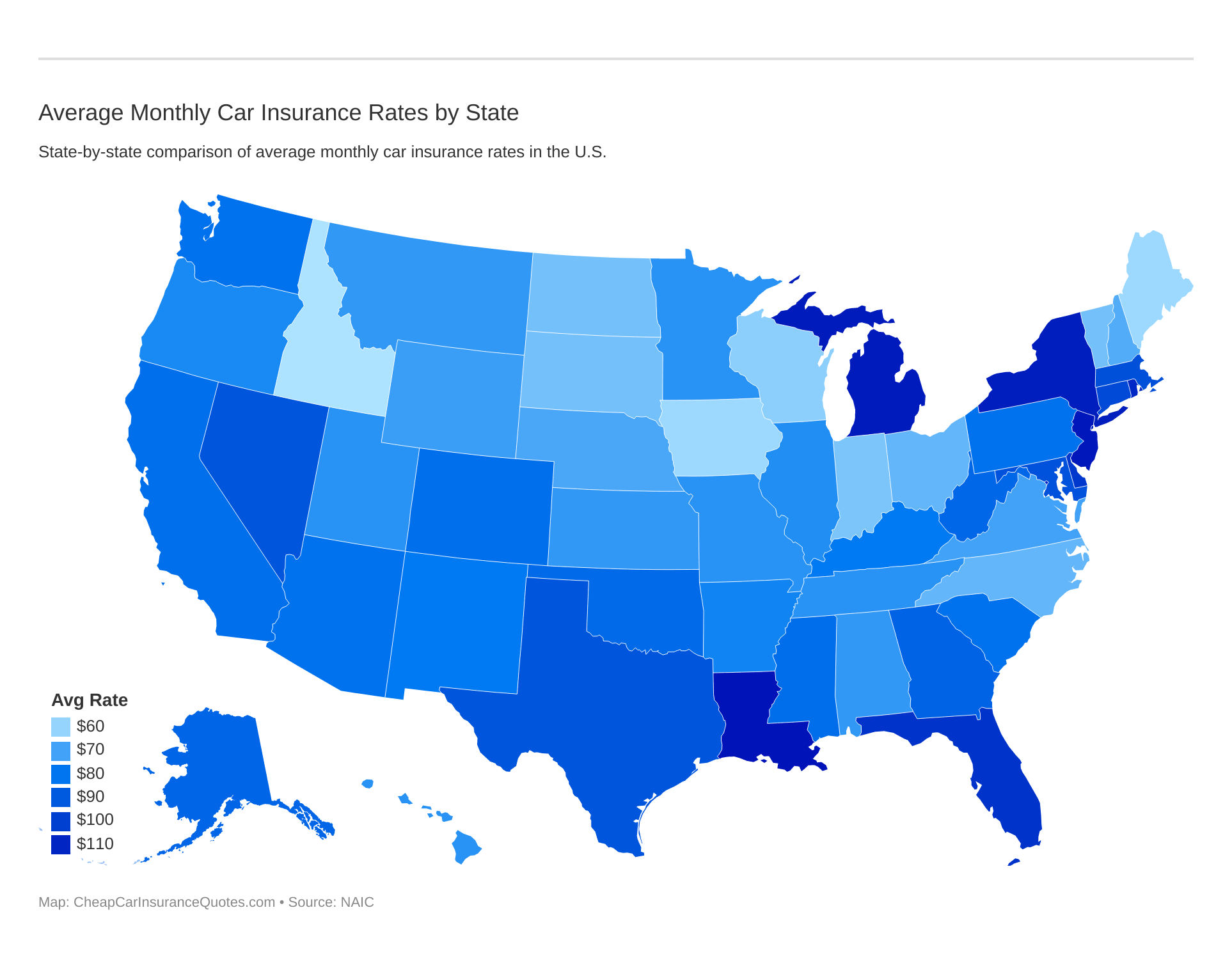

Massachusetts car insurance rates average at $121/mo, or $1,460/yr, which is slightly higher than the national average. There are 25 licensed Massachusetts car insurance companies for local drivers to choose from. With options being more limited, car insurance comparison is even more important. Enter your zip code below to start comparing Massachusetts auto insurance quotes for free.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larsen

Licensed Auto Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Auto Insurance Agent

UPDATED: Feb 16, 2024

It’s all about you. We want to help you make the right cheap car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare cheap car insurance quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Feb 16, 2024

It’s all about you. We want to help you make the right cheap car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare cheap car insurance quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- There are 25 licensed car insurance companies in Massachusetts

- Only six states have lower average premiums than Massachusetts

- Car insurance comparison is more important than ever when your choices are limited

Massachusetts is home to some of the greatest places in the world such as Boston, Martha’s Vineyard, and Cape Cod.

However, when it comes to car insurance, Massachusetts has a lower number of licensed car insurance companies than almost every other state.

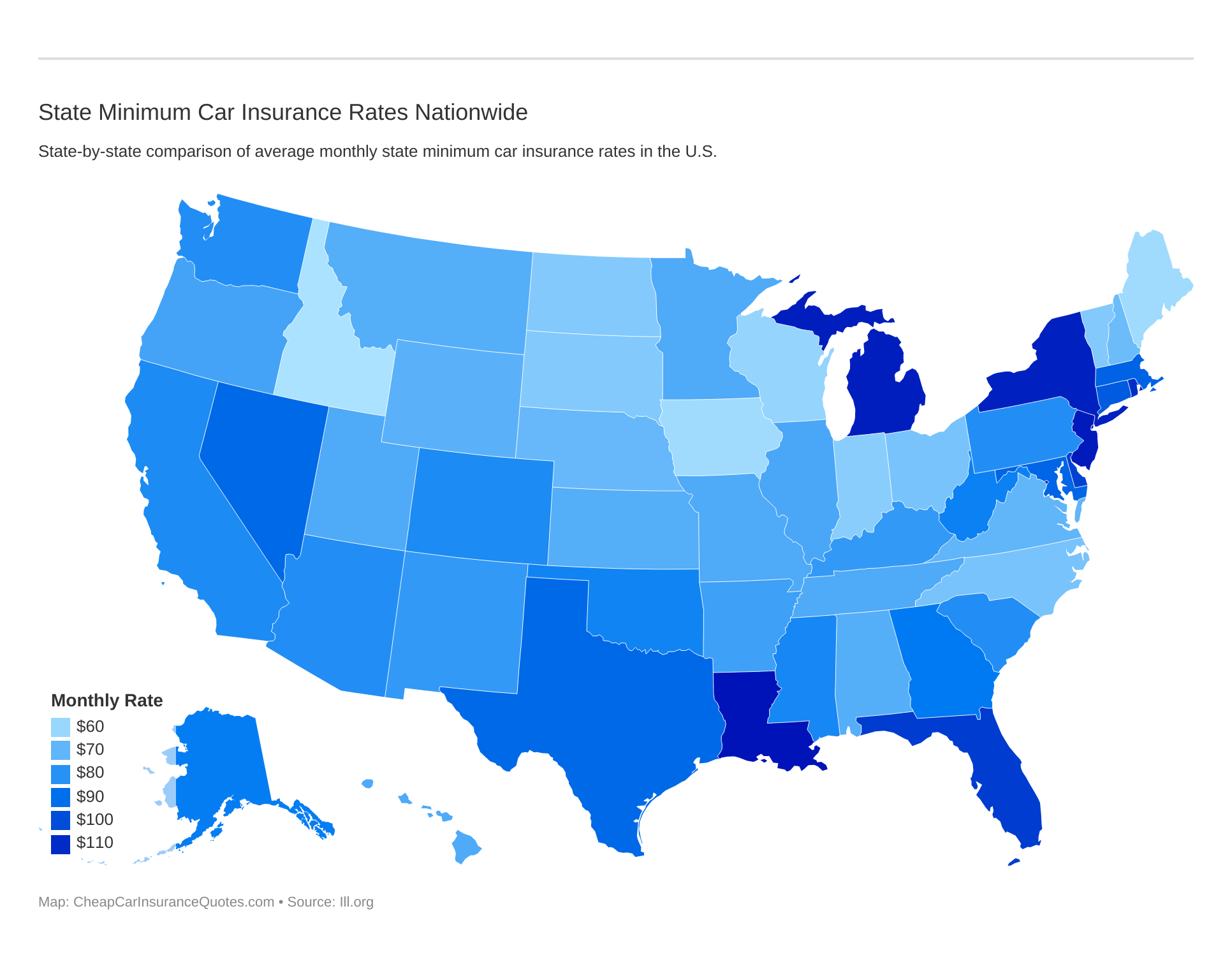

State minimum auto insurance rates and requirements vary from state to state. Compare state to state below:

Do you know how many car insurance companies are in Massachusetts?

Find affordable car insurance today! Enter your zip code above and start comparing quotes for FREE!

How many car insurance companies are in Massachusetts?

Most states have over 100 licensed car insurance companies with some even closing in on 200 so why only 25 licensed car insurance companies in Massachusetts?

A combination of low profits and no-fault car insurance laws have merely limited the number of auto insurers in Massachusetts today.

Drivers have to remember that car insurance companies are not obligated to serve any particular market.

Compare quotes from the top car insurance companies and save Secured with SHA-256 Encryption

Massachusetts Car Insurance Companies

Massachusetts has an estimated 25 car insurance companies licensed to sell auto insurance coverage.

- Massachusetts

- Cheap Quotes for Westborough, MA Car Insurance (2026)

- Cheap Quotes for Middleboro, MA Car Insurance (2026)

- Cheap Quotes for Holbrook, MA Car Insurance (2026)

- Cheap Quotes for Douglas, MA Car Insurance (2026)

- Cheap Quotes for Dighton, MA Car Insurance (2026)

- Cheap Quotes for Cotuit, MA Car Insurance (2026)

- Cheap Quotes for Bolton, MA Car Insurance (2026)

Although this level of competition is much smaller than all other states, the irony is Massachusetts scores exceptionally well on a national scale averaging 25 percent lower average car insurance premiums than the national average of $1,430.00.

In fact, only six states have lower average premiums than Massachusetts.

Your average monthly car insurance rates may not increase as much as you might think by adding additional coverage like comprehensive. Review rates for auto insurance coverage below:

Some of the car insurance companies in Massachusetts include:

- Allstate

- Fireman’s Fund

- Geico

- Liberty Mutual

- Praetorian Insurance

- Progressive

- State Farm

Massachusetts No-Fault Car Insurance Laws

Drivers in Massachusetts may lack a highly competitive car insurance market, but they still benefit from no-fault car insurance laws, so drivers have much less exposure to litigation from car accidents and much faster claim handling since no one is legally at fault.

Massachusetts does require all registered vehicles to have both PIP and liability insurance with the following minimum levels of coverage:

- $20,000 injury liability per person per accident

- $40,000 injury liability per accident (all persons)

- $5,000 property damage liability insurance

- (PIP) Personal Injury Protection

- Uninsured/Underinsured Motorist Coverage

How to Compare Massachusetts Car Insurance Quotes

Even with a small list of car insurance companies, odds are you can’t list every single one. Car insurance comparison is more important than ever when your choices are limited.

Try to learn about the types of car insurance, how policy deductibles work, what levels of coverage are sufficient, and read car insurance company reviews before comparing car insurance quotes.

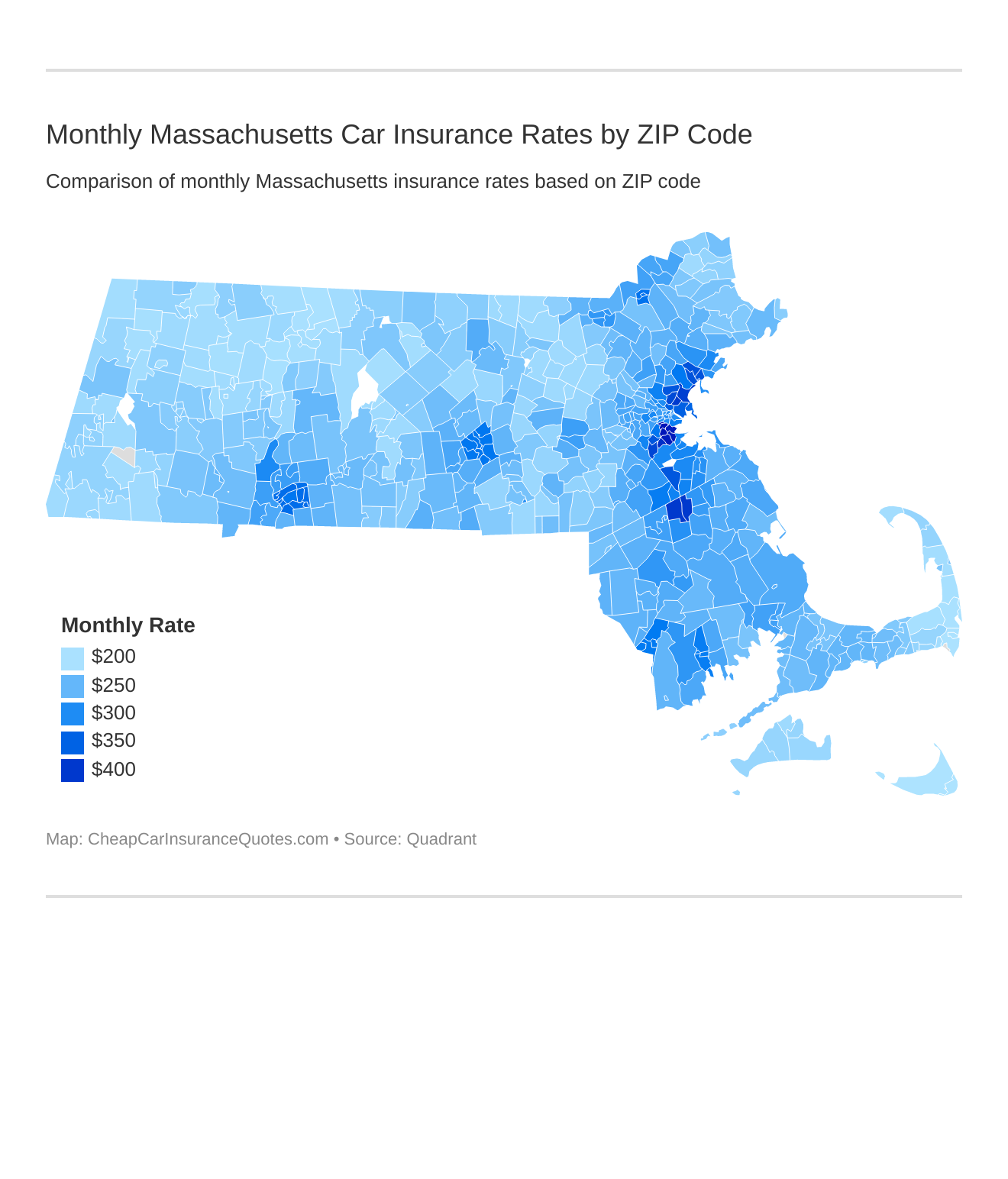

ZIP codes affect auto insurance because of factors like traffic, crime to name a few. Find out how your ZIP code stacks up in MA.

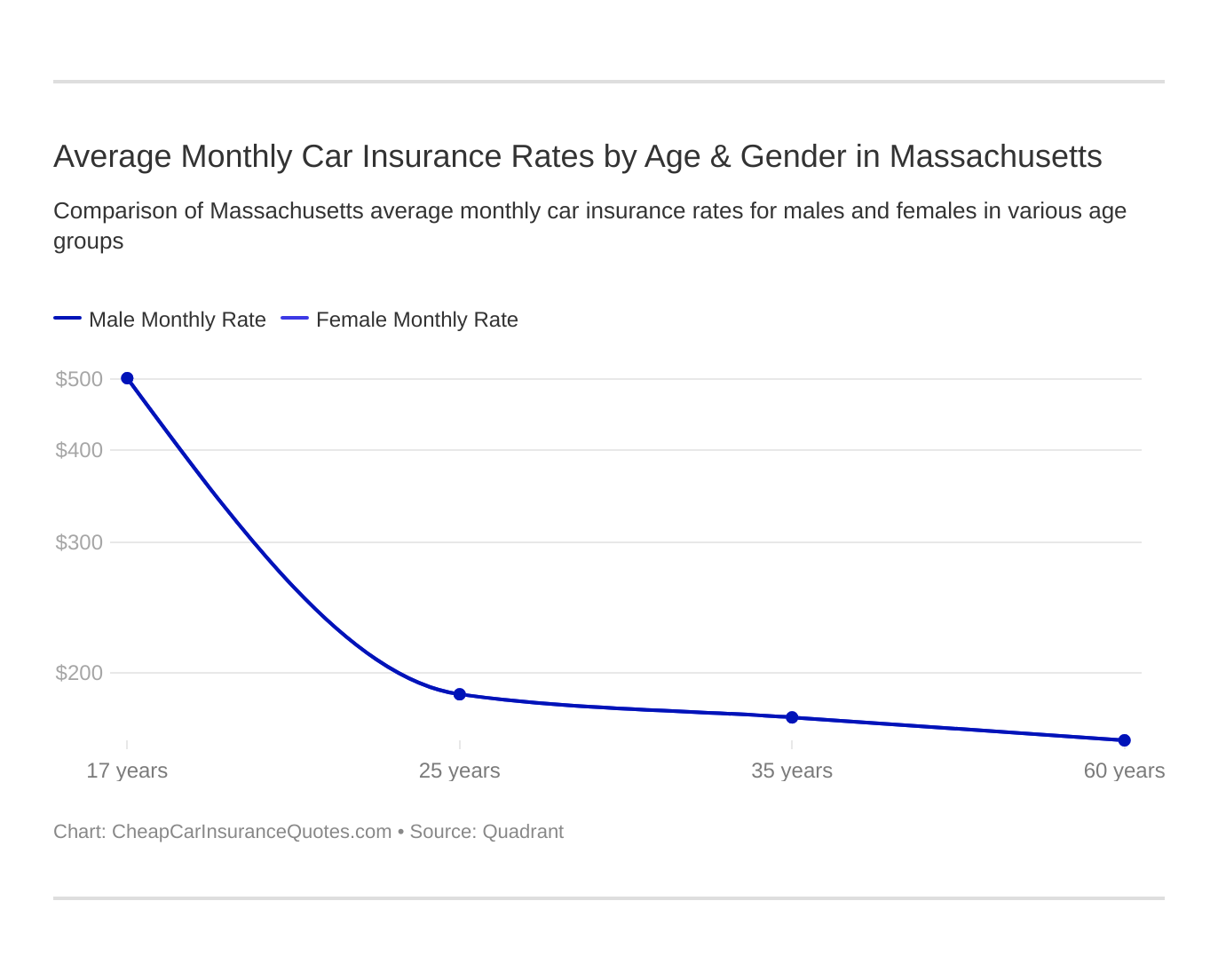

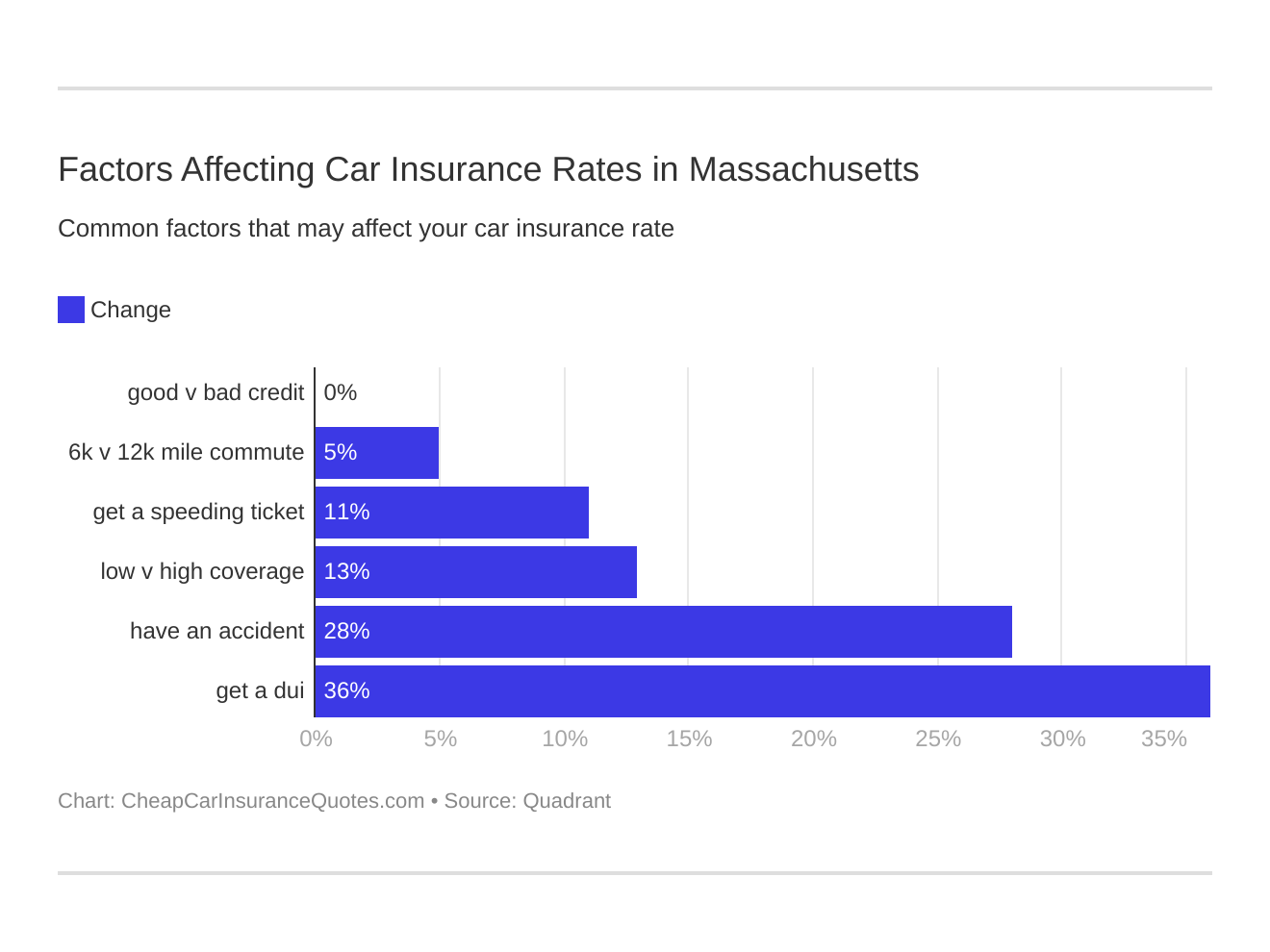

Some states have banned discrimination based on gender for car insurance rates, and this is one of those few states. As you can see the rate for males and females is the same, but the rate still varies with age.

Some states have banned discrimination based on your credit score when it comes to auto insurance rates, and this is one of those States.

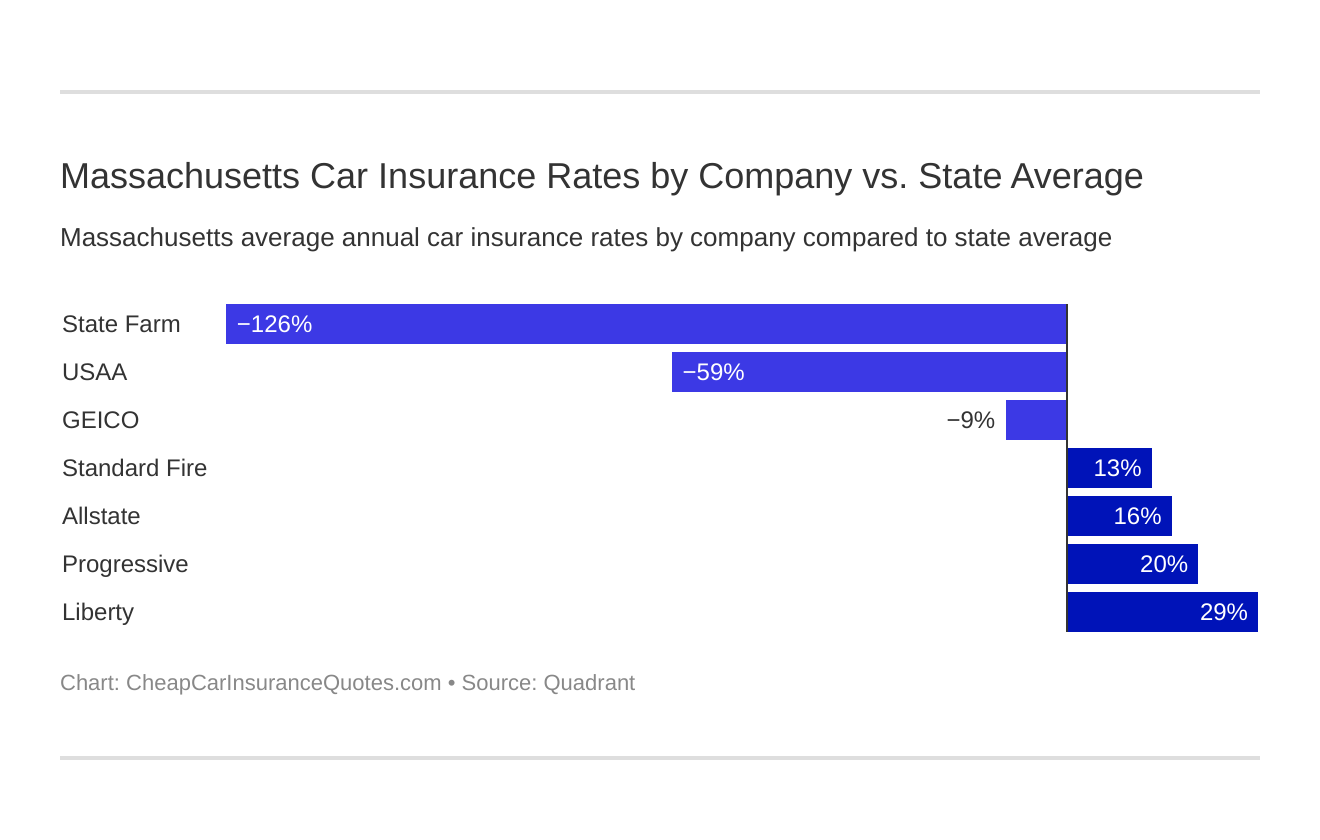

Who is the cheapest car insurance company in MA? Review the average auto insurance rates by company below:

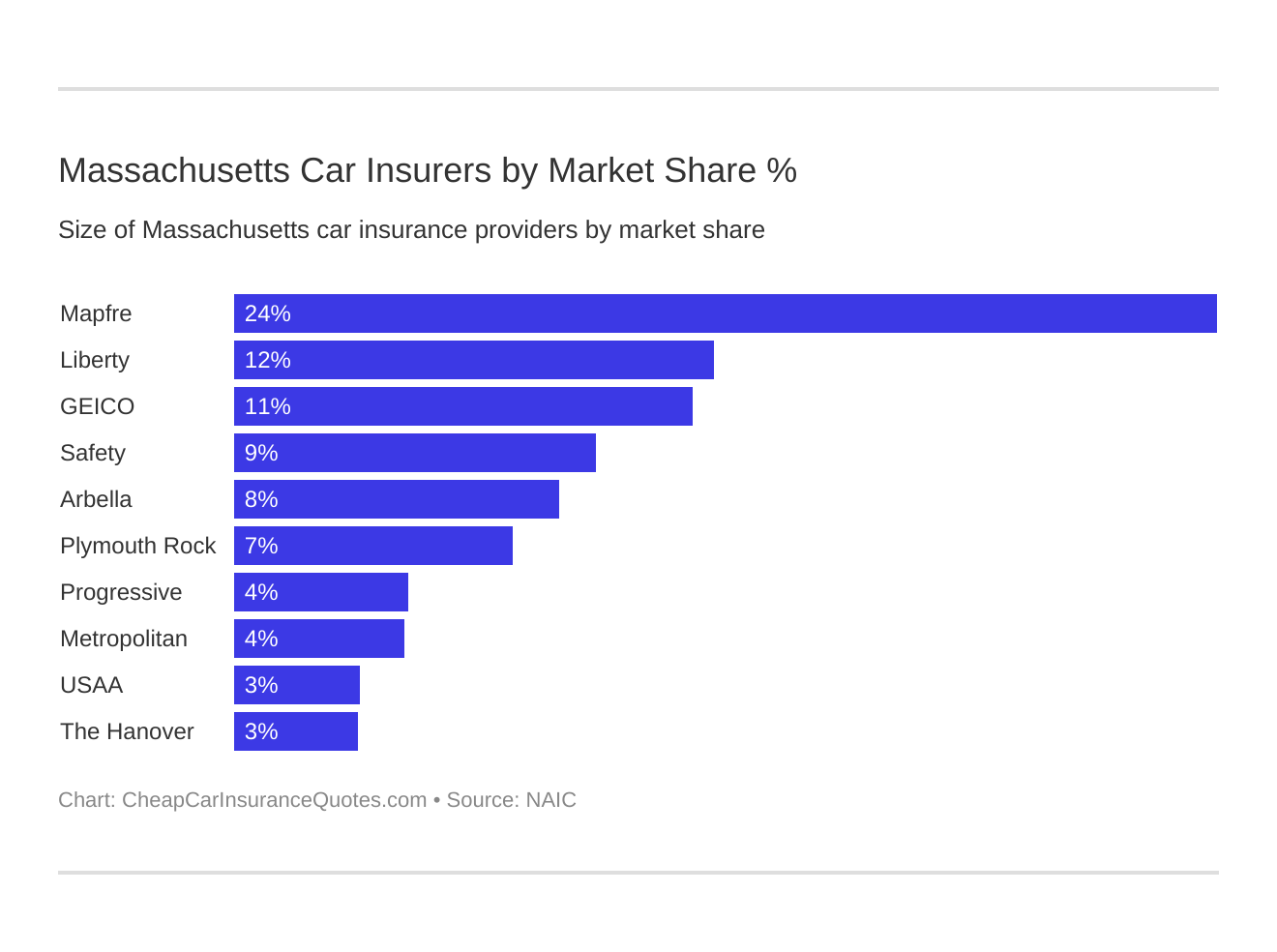

Who are the largest auto insurance companies in MA?

Finding the best car insurance policy for your profile will mean comparing systems equally so the road to the best car insurance coverage will start with education

Ready to Compare? Find Massachusetts car insurance rates today! Enter your zip code below to get started for FREE!

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Brad Larsen

Licensed Auto Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.