New Jersey Car Insurance

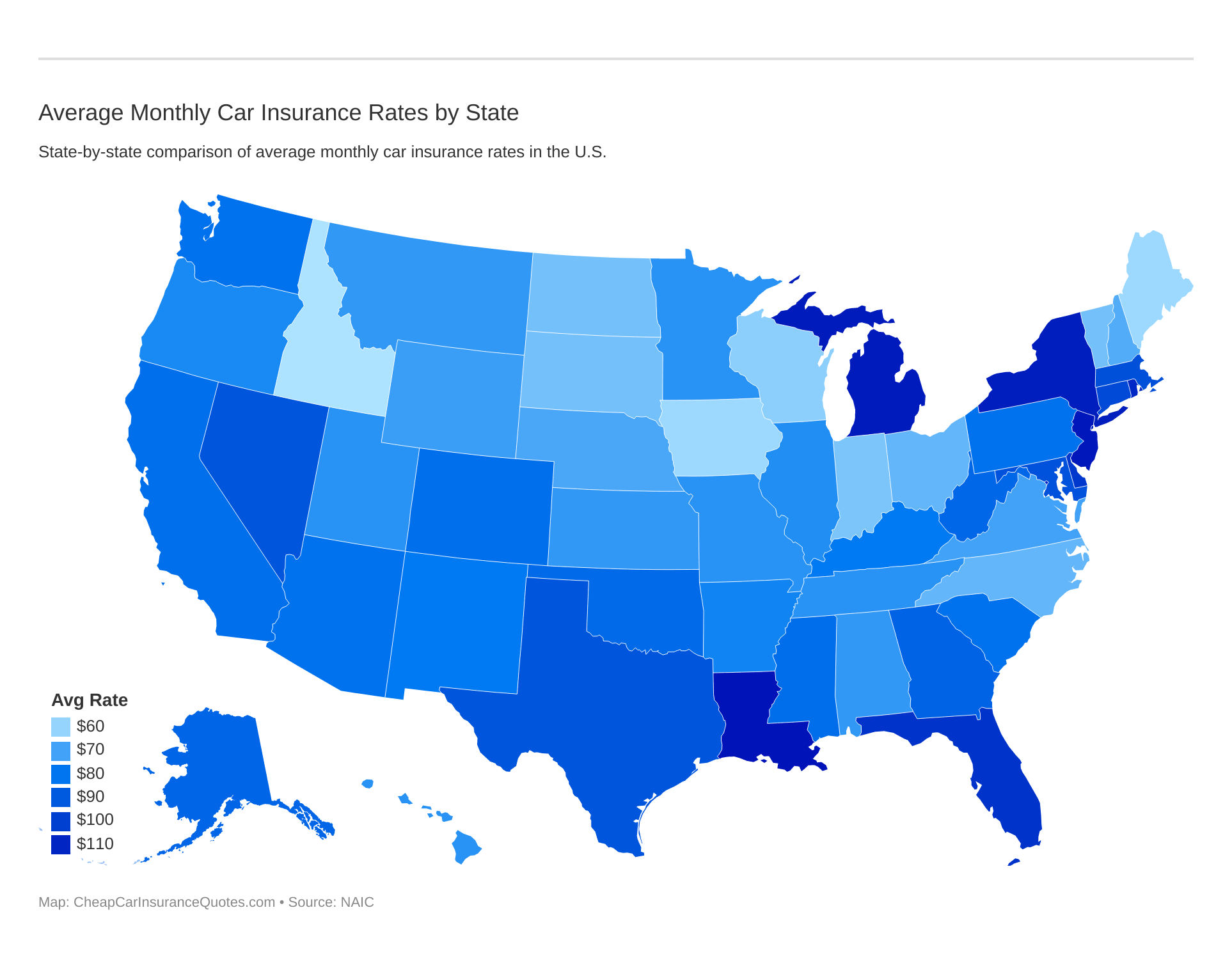

New Jersey car insurance costs $132/mo, or $1,592/yr on average, which is a little more expensive than the national average. New Jersey is a unique state for car insurance laws as it operates under no-fault car insurance but also offers drivers multiple options for car insurance coverage to assist low-income families. Start shopping for affordable New Jersey auto insurance rates here with our free comparison tool below.

Read moreFree Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larsen

Licensed Auto Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Auto Insurance Agent

UPDATED: Feb 16, 2024

It’s all about you. We want to help you make the right cheap car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare cheap car insurance quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Feb 16, 2024

It’s all about you. We want to help you make the right cheap car insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare cheap car insurance quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- New Jersey is a trendy market for car insurance companies, and insurers compete heavily in the marketplace

- The state of New Jersey’s Department of Banking & Insurance requires all vehicles to maintain auto insurance at all times

- New Jersey car insurance laws help some drivers who otherwise could not coverage have some form of protection

New Jersey is a unique state for car insurance laws as it operates under no-fault car insurance laws but also offers drivers multiple options for car insurance to assist families with fewer assets and obligations afford coverage.

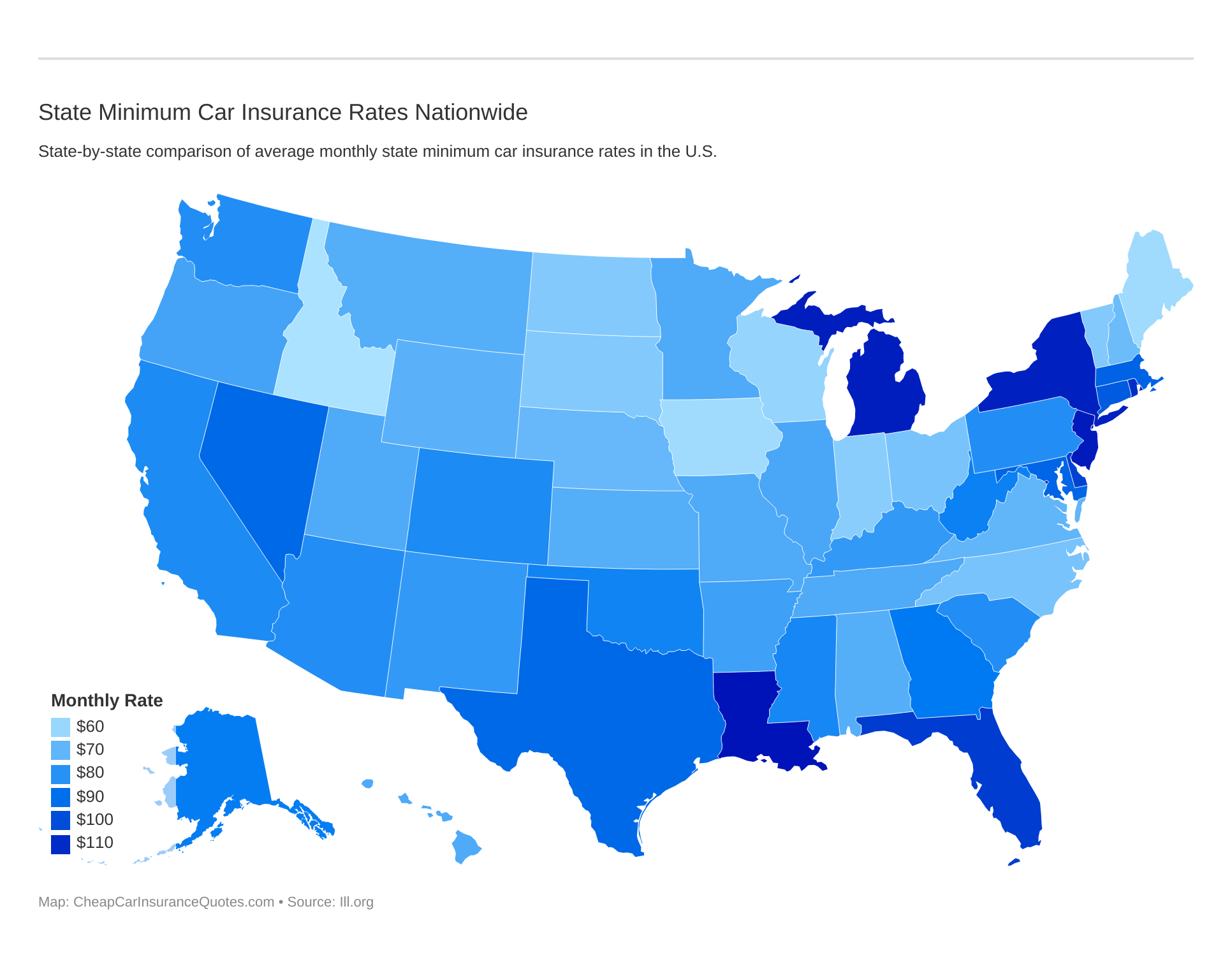

State minimum auto insurance rates and requirements vary from state to state. Compare state to state below:

The number of uninsured motorists is staggering in many states, and New Jersey car insurance laws help some drivers who otherwise could not coverage have some form of protection.

Ready to compare car insurance quotes in New Jersey? Enter your zip code above and start comparing quotes now!

Car Insurance is Mandatory in New Jersey

Fines and penalties for driving with no car insurance are very stiff in New Jersey and potentially expose you to significant personal liability not to mention possible vehicle impoundment, suspension of your driver’s license, vehicle registration tags and even a felony conviction under some circumstances.

The state of New Jersey’s Department of Banking & Insurance requires all vehicles to maintain auto insurance at all times.

What’s unique about New Jersey car insurance laws is the state has two options for drivers to comply with minimum auto insurance requirements.

- New Jersey

- Cheap Quotes for West Orange, NJ Car Insurance (2026)

- Cheap Quotes for Sea Isle City, NJ Car Insurance (2026)

- Cheap Quotes for Pennsville, NJ Car Insurance (2026)

- Cheap Quotes for Linden, NJ Car Insurance (2026)

- Cheap Quotes for Glassboro, NJ Car Insurance (2026)

- Cheap Quotes for Cream Ridge, NJ Car Insurance (2026)

- Cheap Quotes for Belle Mead, NJ Car Insurance (2026)

This additional option was passed from the result of the Automobile Insurance Cost Reduction Act and aimed at providing drivers with fewer obligations and assets a way to obtain car insurance coverage at a lower cost.

Of course, any kind of state minimum car insurance requirements is usually far less than you need in an ideal world.

This lower cost auto insurance option may help some people afford a policy which either (a) they could not afford before or (b) provide the minimal protection their circumstances require.

Your average monthly car insurance rates may not increase as much as you might think by adding additional coverage like comprehensive. Review rates for auto insurance coverage below:

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

New Jersey drivers have two options for meeting state minimum car insurance laws including:

- $15,000 bodily injury protection per person per accident

- $30,000 bodily injury protection per accident for all persons

- $5,000 of property damage insurance

- $15,000 PIP (Personal Injury Protection) coverage per person

- $15,000 UIM (uninsured/underinsured motorist coverage) per person per accident

- $30,000 UIM (uninsured/underinsured motorist coverage) per person per accident

The basic policy provides almost no coverage, but it will help you avoid the roller coaster effect of driving with no car insurance and cover damage in some very minor accidents.

Drivers who opt for the underlying policy can also purchase up to $10,000 of liability insurance and smaller amounts of comprehensive and collision coverage, although additional types of coverage such as UIM or GAP may not be available.

Can I sue for car accident injuries in New Jersey?

New Jersey operates under no-fault car insurance laws, but drivers have a choice in New Jersey whether or not to retain or waive the right to sue for damages from a future car accident.

Whenever you purchase an NJ car insurance policy, you will be asked about this, and it’s not a choice you can retract.

Drivers must choose between:

- Unlimited Right to Sue – This provides you the right to sue for damages from a car accident in the future.

- Limited Right to Sue – If you choose this option then all your rights to sue are waived except for a small list of car accident related injuries including fetus loss, death, and some other extreme injuries. You can still sue for loss of income but choose this option severely limits your future legal rights so never take this option without the advice of proper legal counsel.

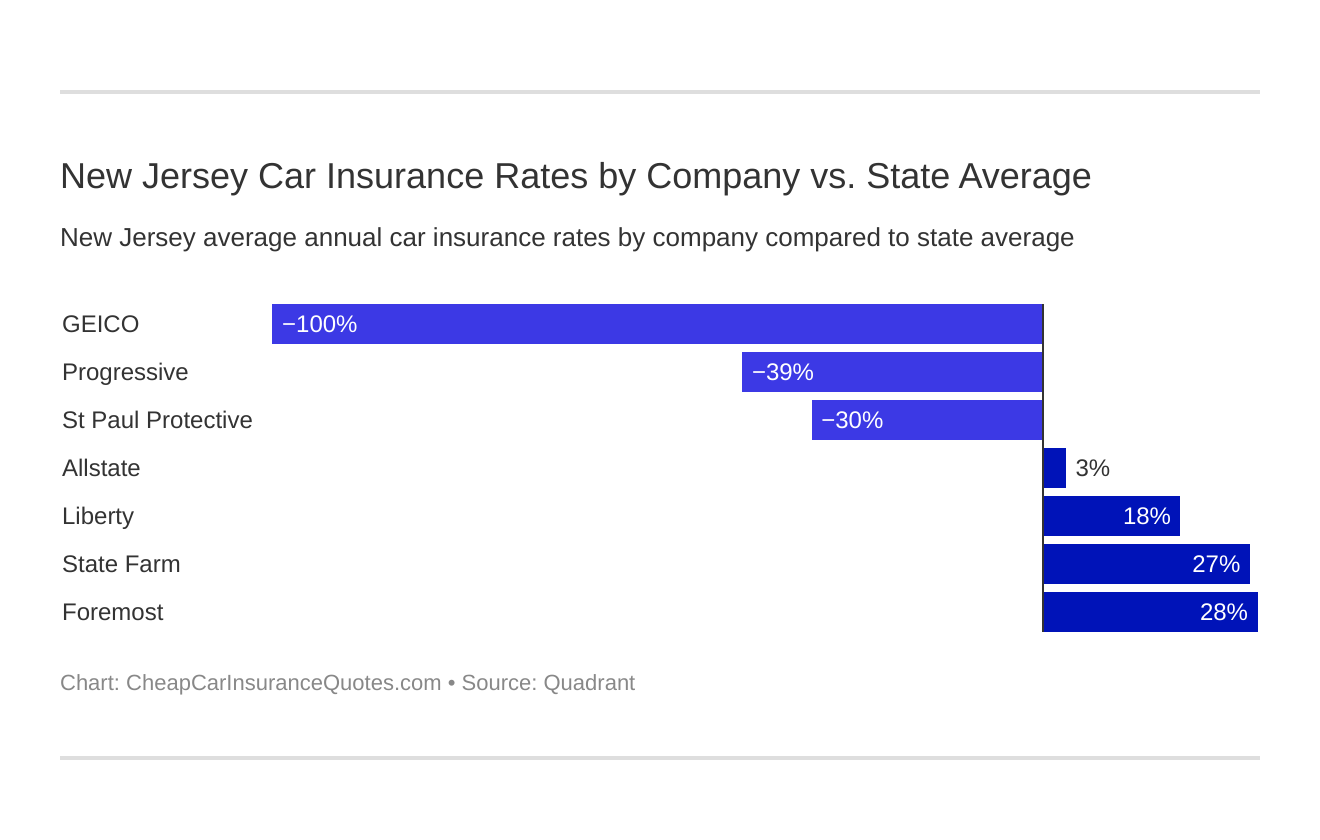

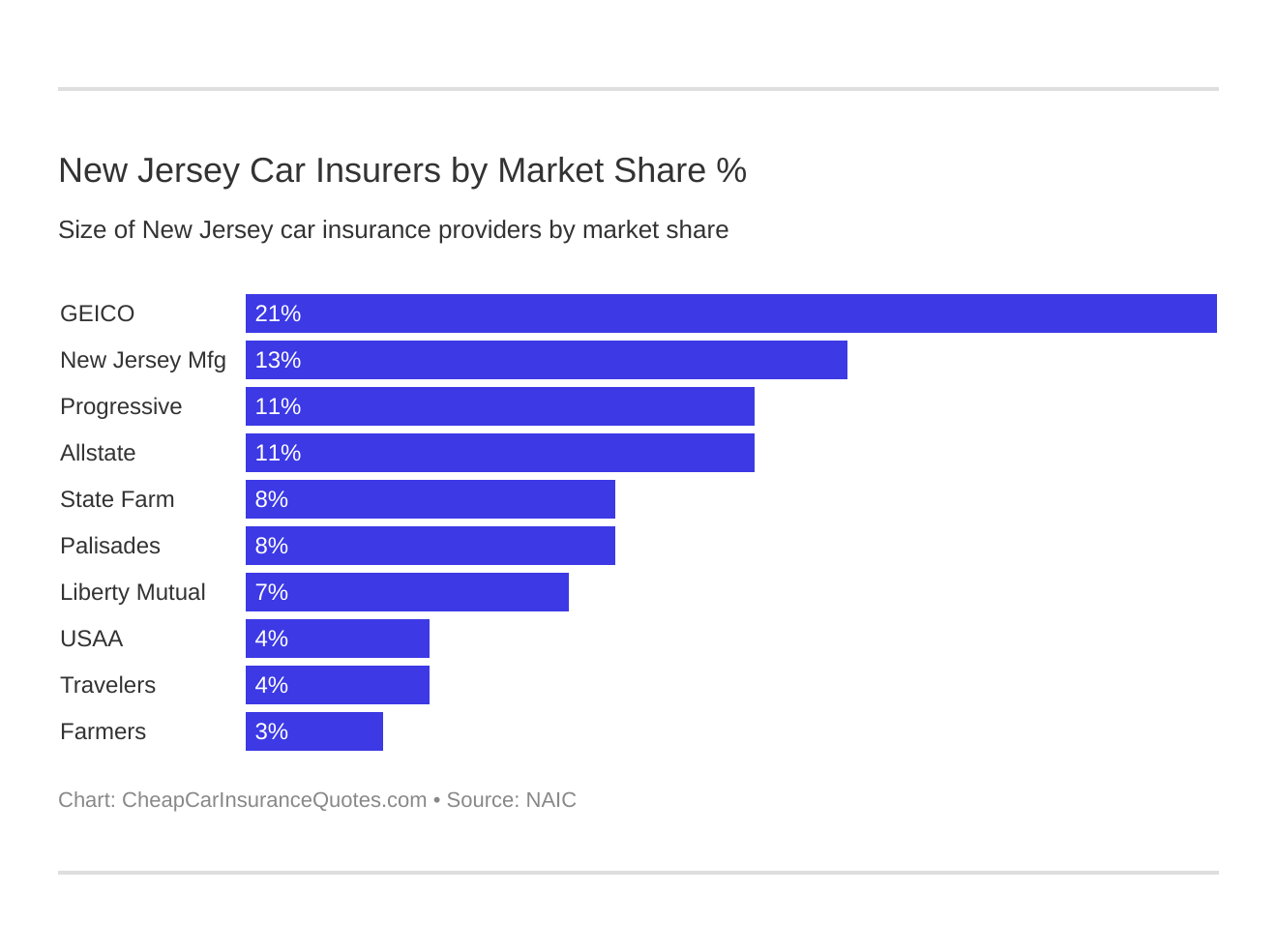

New Jersey is a very popular market for car insurance companies, and insurers compete heavily in the marketplace. Drivers have a vast number of providers to choose from including both national brands and superb regional providers.

The key to finding the best NJ car insurance rates will be to spend time and compare New Jersey auto insurance companies which most drivers do with a car insurance comparison search online

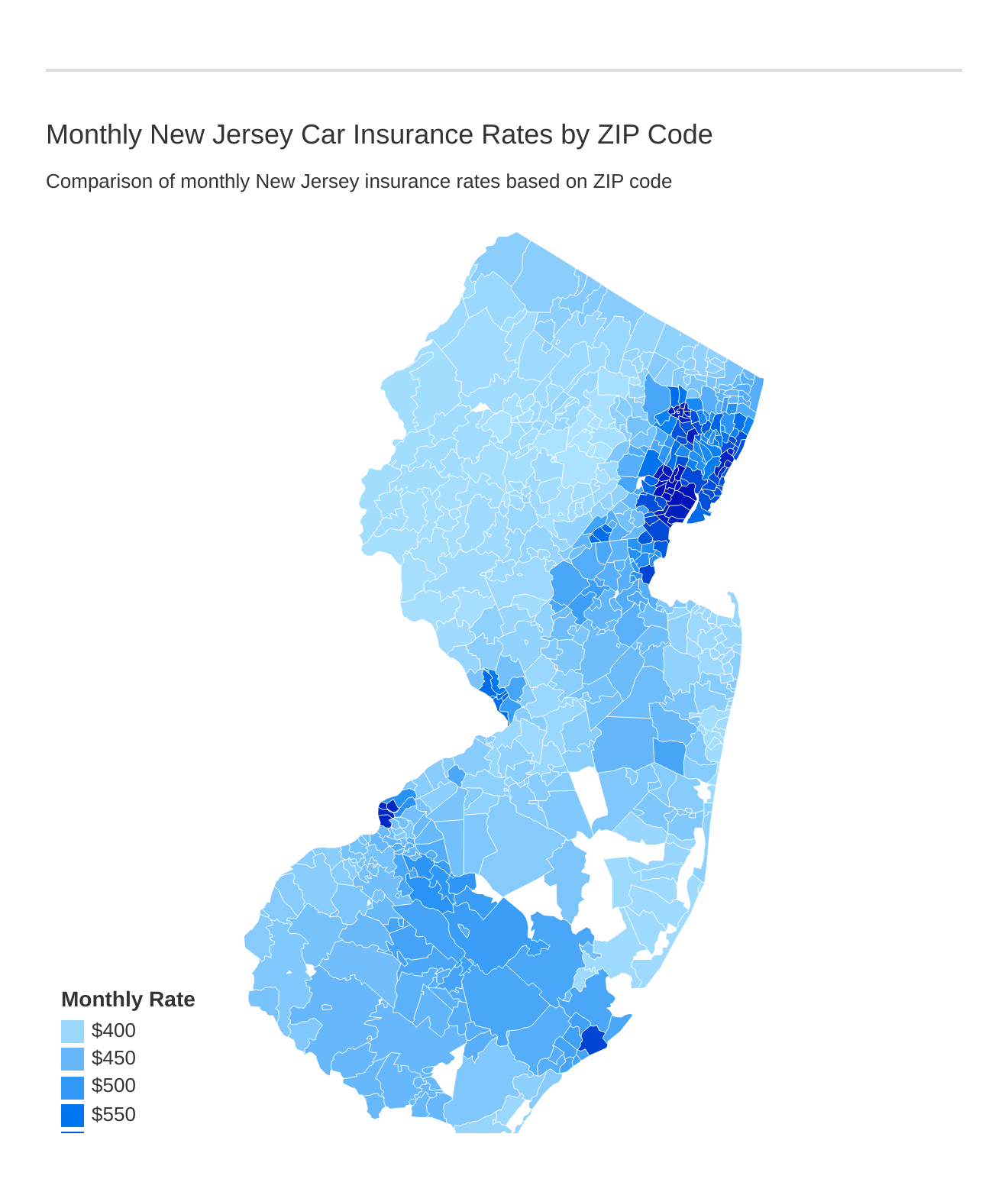

ZIP codes affect auto insurance because of factors like traffic, crime to name a few. Find out how your ZIP code stacks up in NJ.

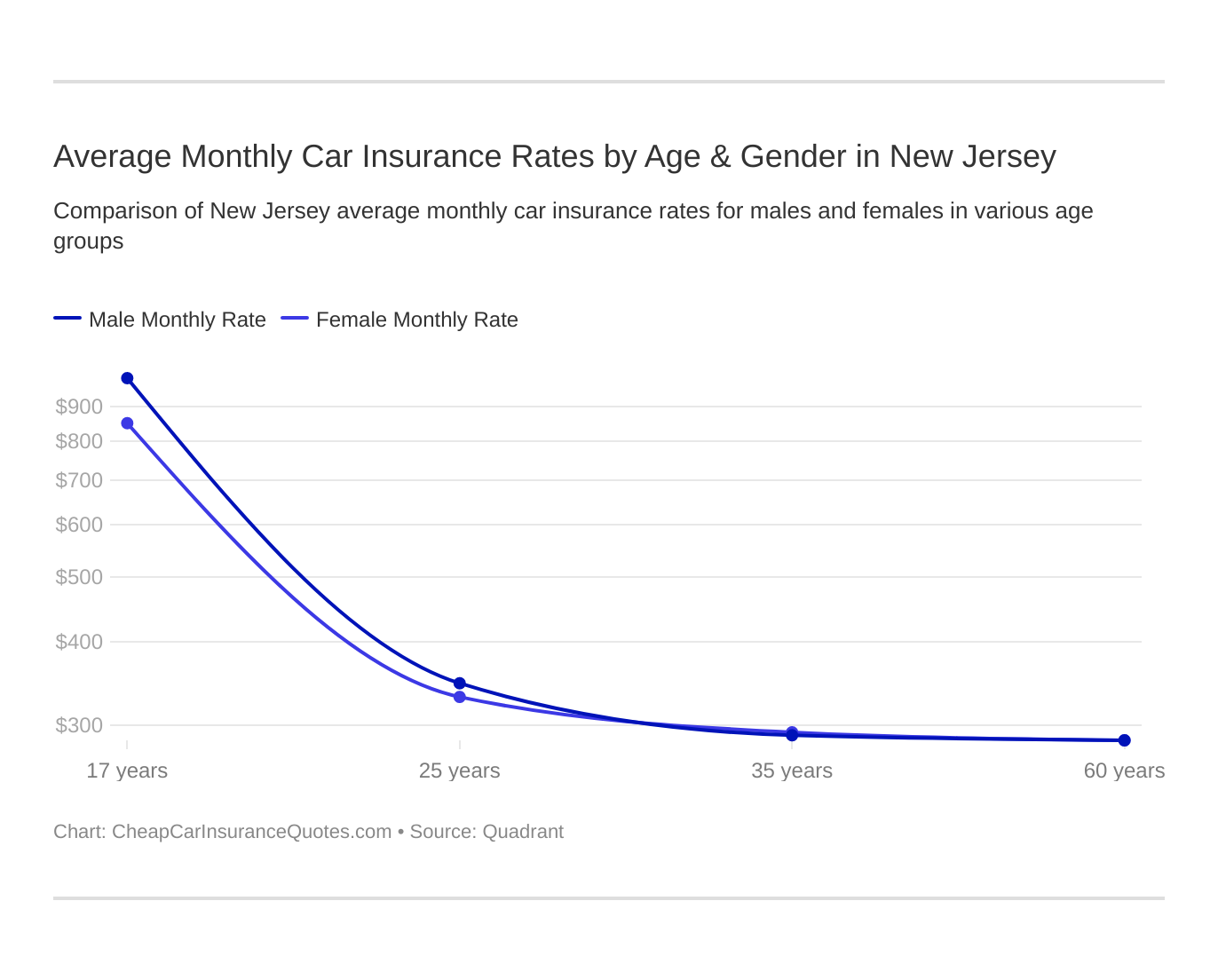

Gender and age will affect your auto insurance. Younger drivers are often in a higher risk class. See if the gender stereotype (males vs female car insurance rates) holds true in NJ.

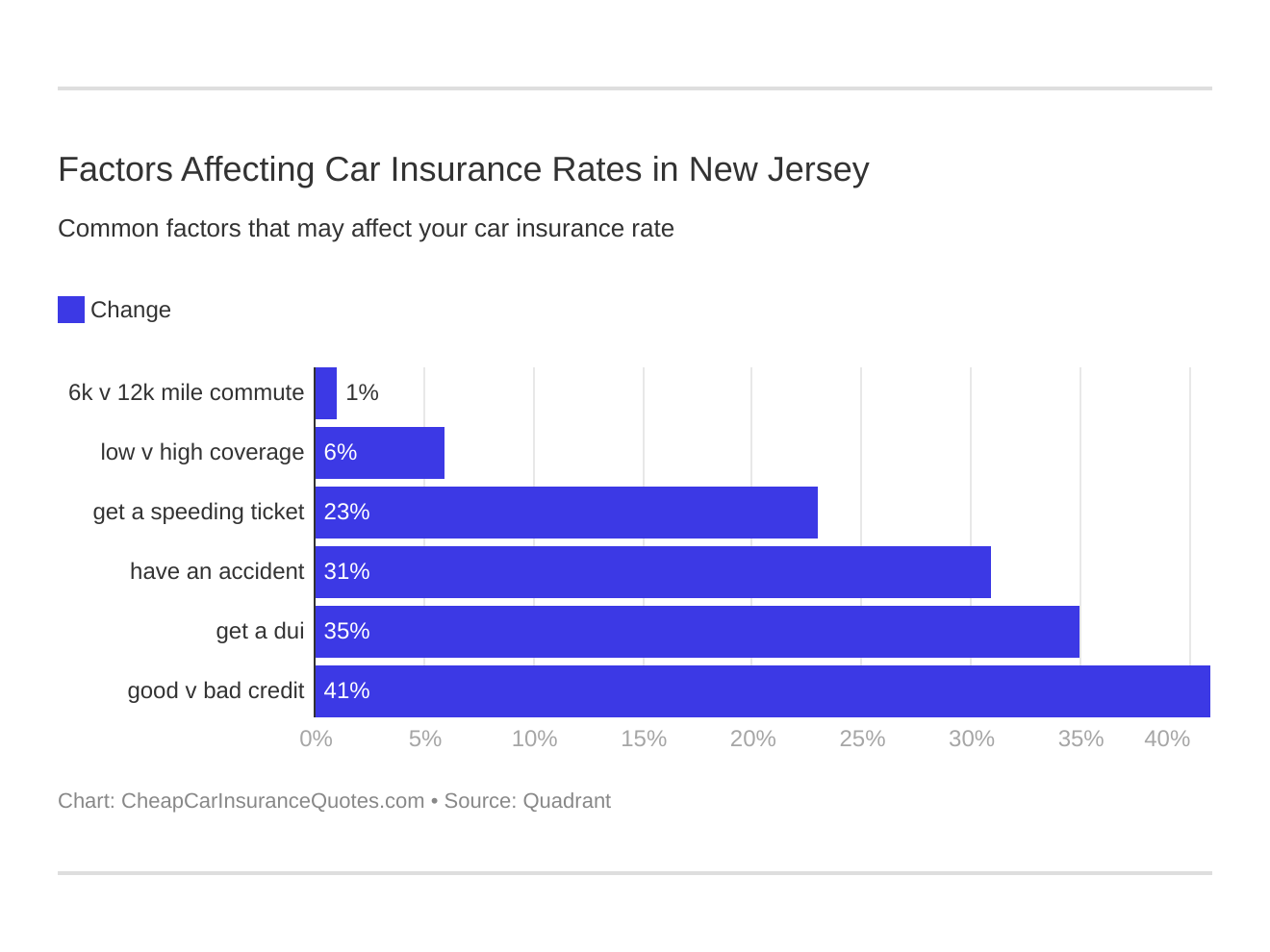

Six major factors affect car insurance rates in New Jersey. Which auto insurance factors will affect rates the most? Find out below:

Now let’s see who is the cheapest car insurance company in New Jersey.

Who are the largest car insurance companies in New Jersey?

| Car Insurance Cost in New Jersey by City | |

|---|---|

| Belle Mead, NJ | Pennsville, NJ |

| Cream Ridge, NJ | Sea Isle City, NJ |

| Glassboro, NJ | West Orange, NJ |

| Linden, NJ |

Ready to compare car insurance quotes? Enter your zip code below and start comparing car insurance quotes for FREE!

Compare quotes from the top car insurance companies and save

Secured with SHA-256 Encryption

Brad Larsen

Licensed Auto Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance-related. We update our site regularly, and all content is reviewed by car insurance experts.